941 Reconciliation Template Excel

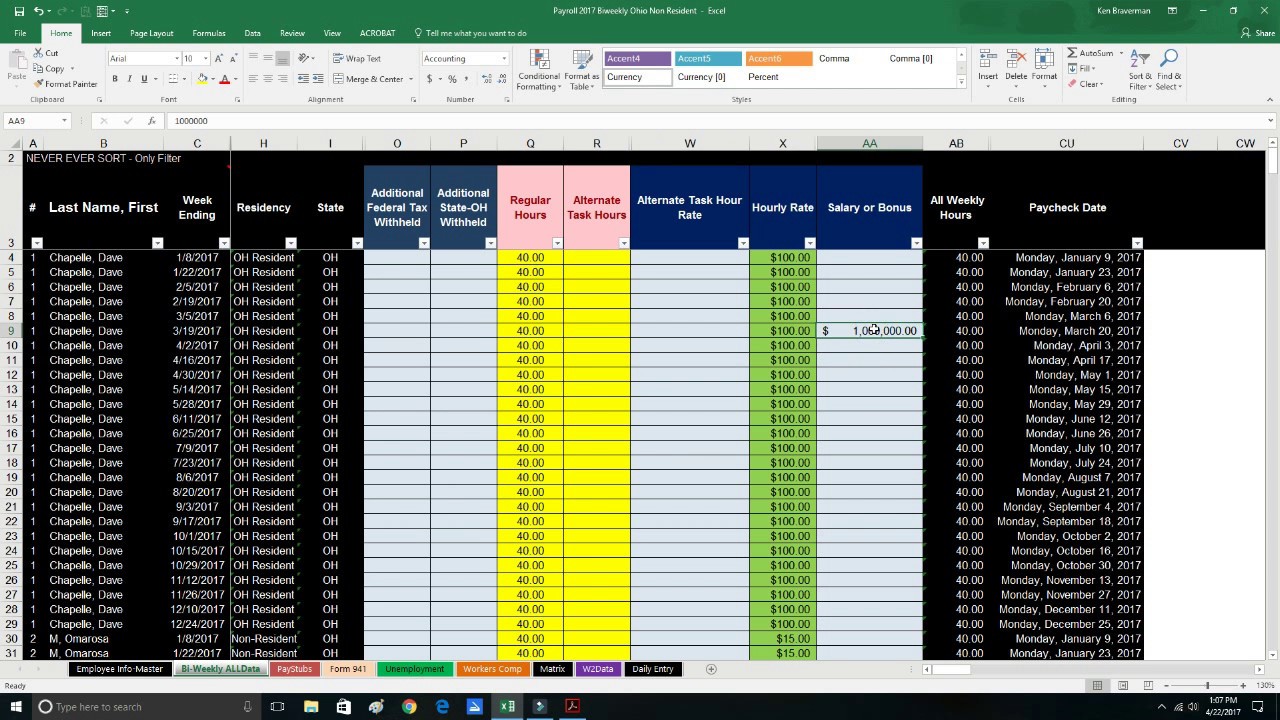

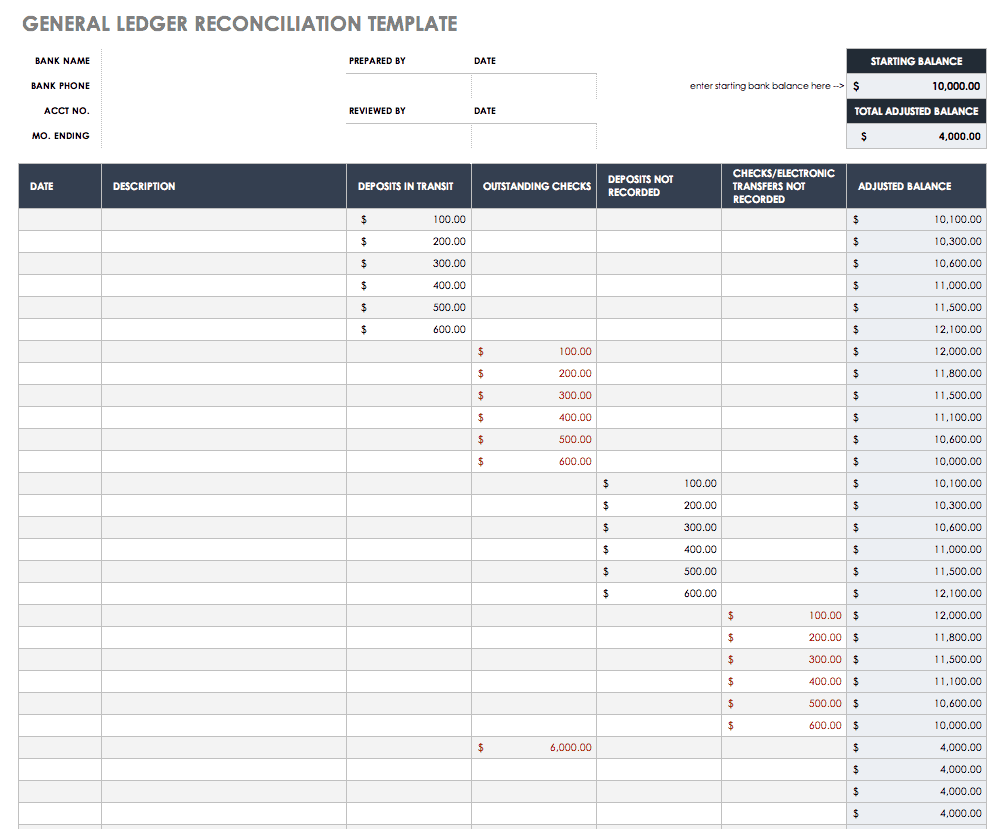

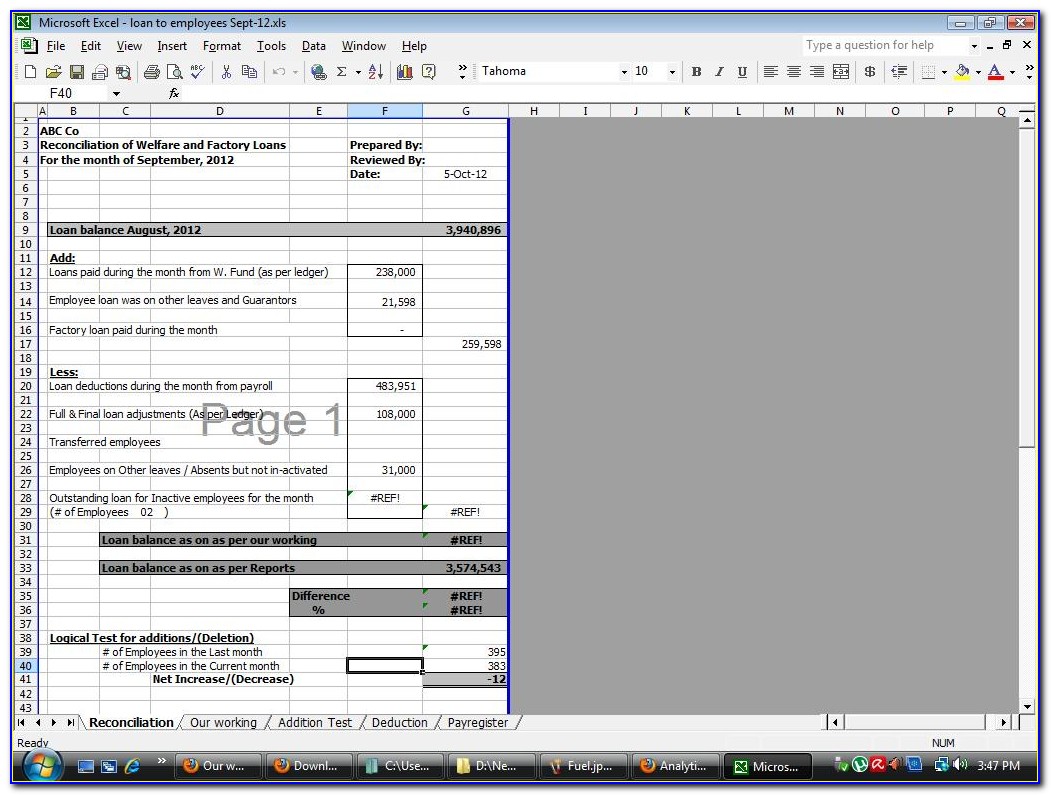

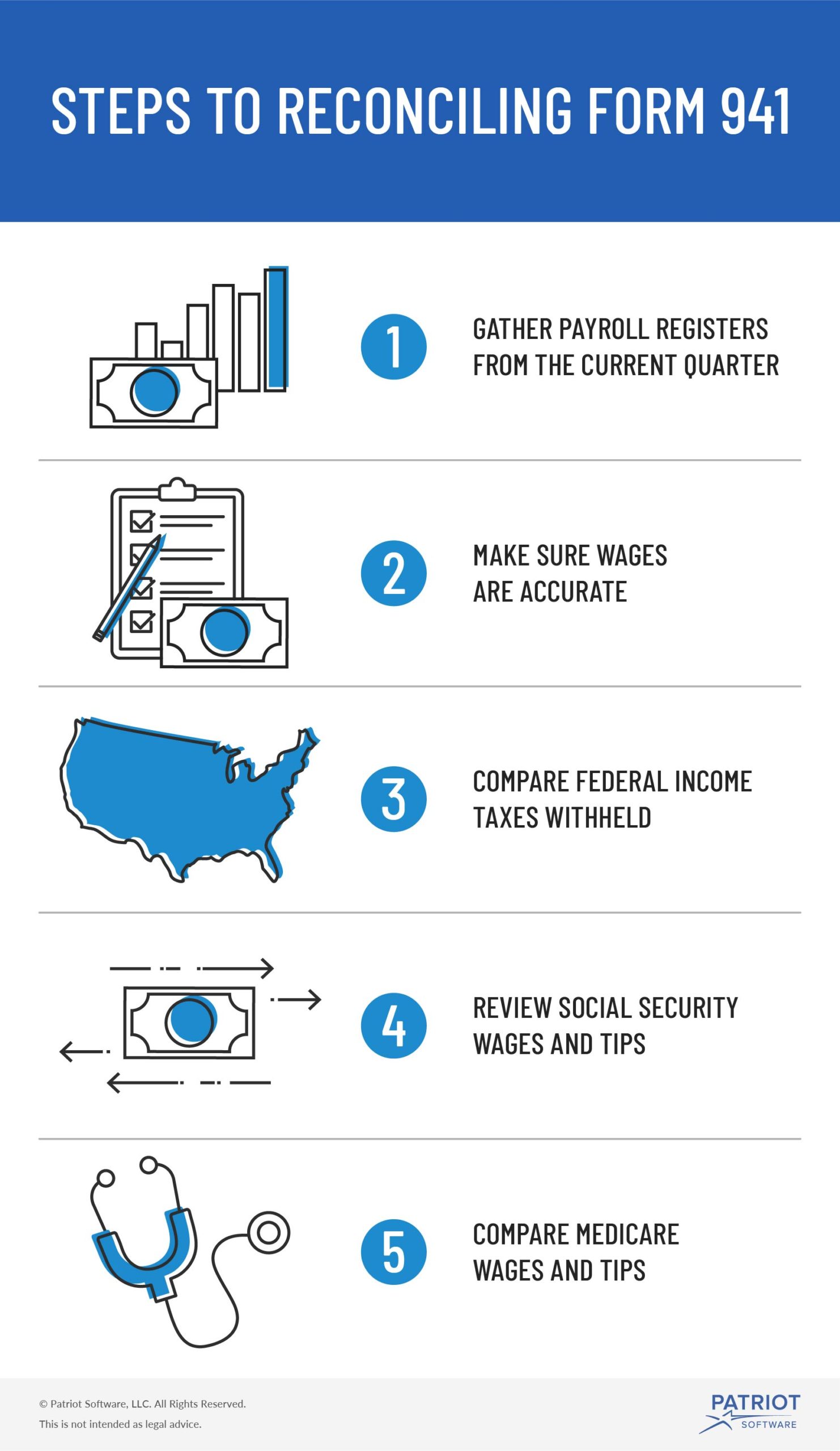

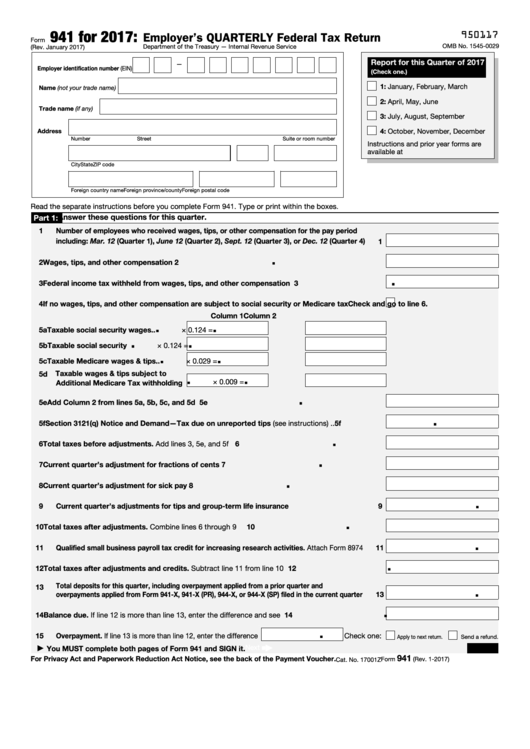

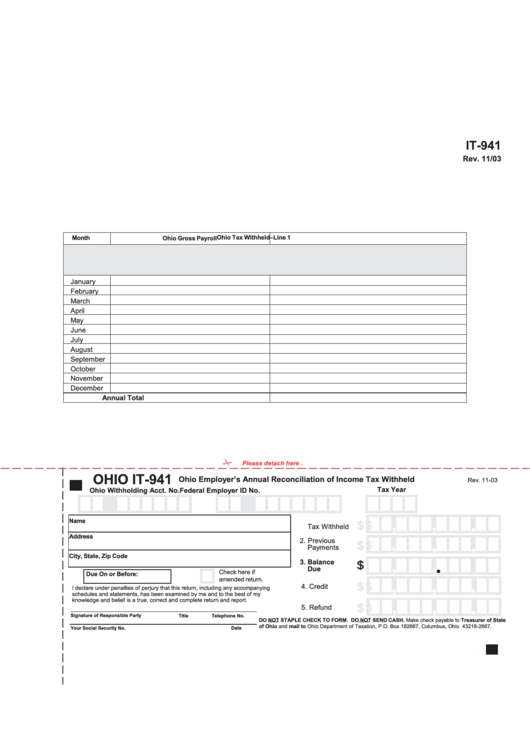

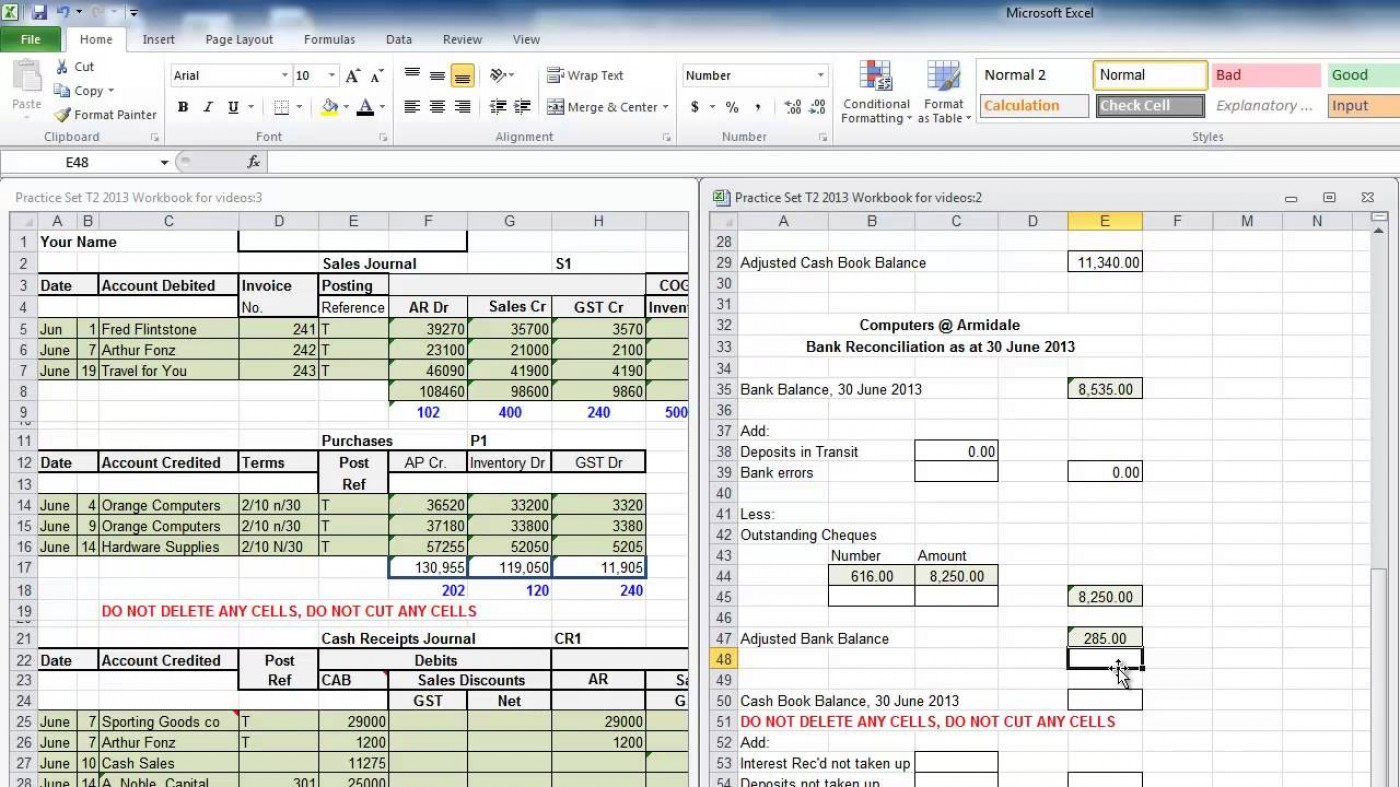

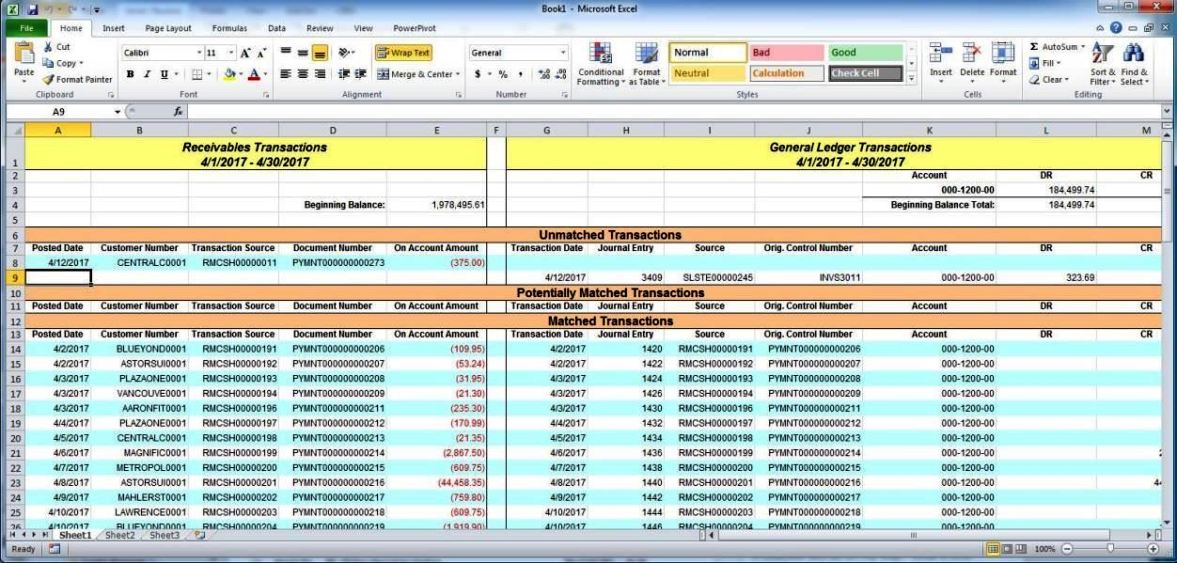

941 Reconciliation Template Excel - Run a payroll register for the quarter. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. The register should show wages and deductions for each employee during that quarter. You must complete all five pages. Web export report to excel 5. At this time, the irs expects the march. Use this report to fill out the correct 941. Web follow these five simple steps to reconcile form 941. Manage all your business expenses in one place with quickbooks®. Enter column totals from the payroll check register summary (smartlist) into the payroll reconciliation. Type or print within the boxes. Ad track everything in one place. If these forms are not in balance, penalties from the irs and/or ssa could result. Ad download or email irs 941 & more fillable forms, register and subscribe now! To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Don't use an earlier revision to report taxes for 2023. Ad download or email irs 941 & more fillable forms, register and subscribe now! Type or print within the boxes. Web reconciliation templates excel make reconciliation documents with template.net's free reconciliation templates excel. Gather payroll registers from the current quarter. You must complete all five pages. Ad pdffiller.com has been visited by 1m+ users in the past month Whether you track payroll taxes and wages in a. Does my general ledger match my payroll expenses? Enjoy smart fillable fields and interactivity. Web up to 50% cash back below are the best free online top 10 payroll reconciliation template excel. At this time, the irs expects the march. Compare the data on the. Use on any account, petty cash, ledger, or. Does my general ledger match my payroll expenses? Don't use an earlier revision to report taxes for 2023. Web ðï ࡱ á> þÿ 1. Does my general ledger match my payroll expenses? This worksheet does not have to be. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; At this time, the irs expects the march. Ad embarkwithus.com has been visited by 10k+ users in the past month You must complete all five pages. Web ðï ࡱ á> þÿ 1. Web follow these five simple steps to reconcile form 941. Gather payroll registers from the current quarter. Ad pdffiller.com has been visited by 1m+ users in the past month Web export report to excel 5. Your total payroll expenses must match what you’ve posted in your general ledger. This worksheet does not have to be. Get your online template and fill it in using progressive features. Ad pdffiller.com has been visited by 1m+ users in the past month Type or print within the boxes. Compare the data on the. The register should show wages and deductions for each employee during that quarter. Explore the #1 accounting software for small businesses. You must complete all five pages. Ad track everything in one place. If these forms are not in balance, penalties from the irs and/or ssa could result. Web how to fill out and sign 941 reconciliation template excel online? Web ðï ࡱ á> þÿ 1. Don't use an earlier revision to report taxes for 2023. Ad track everything in one place. You can customize all of the templates offered below for. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. The register should show wages and deductions for each employee during that quarter. Enter column totals from the payroll check register summary (smartlist) into the payroll reconciliation. Whether you track payroll taxes and wages in a. You can customize all of the templates offered below for. Ad download or email irs 941 & more fillable forms, register and subscribe now! Web export report to excel 5. Web ðï ࡱ á> þÿ 1. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Web complete the payroll reconciliation once the year end's payroll is finalized and prior to sending the fourth quarter form 941 or the annual form 944 to the irs. Manage all your business expenses in one place with quickbooks®. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. At this time, the irs expects the march. Gather payroll registers from the current quarter. Ad embarkwithus.com has been visited by 10k+ users in the past month Explore the #1 accounting software for small businesses. Type or print within the boxes. Use on any account, petty cash, ledger, or. Your total payroll expenses must match what you’ve posted in your general ledger. This worksheet does not have to be. Ad pdffiller.com has been visited by 1m+ users in the past monthHow to File Quarterly Form 941 Payroll in Excel 2017 YouTube

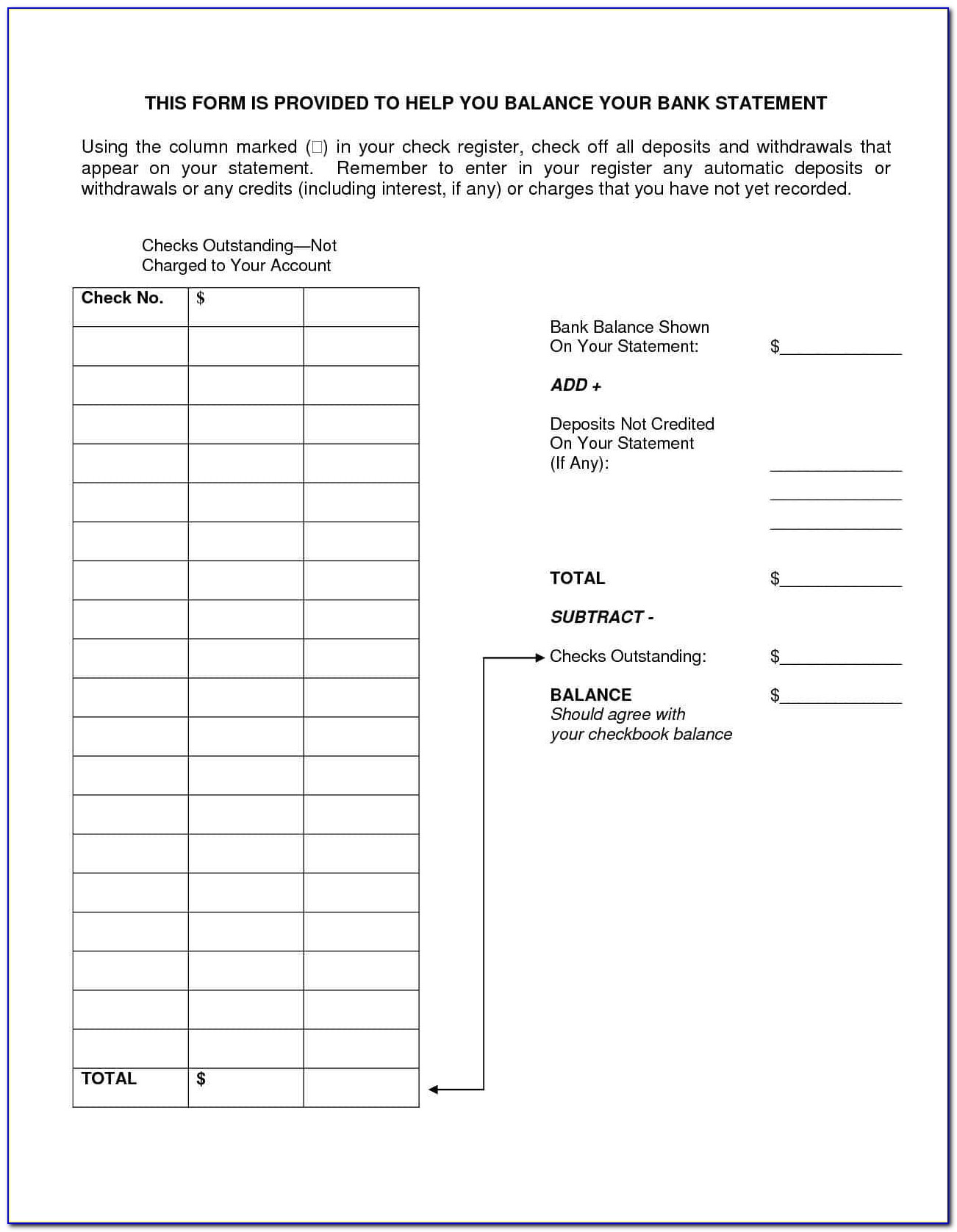

Free Account Reconciliation Templates Smartsheet

941 Reconciliation Template Excel

941 Reconciliation Template Excel

106 Form 941 Templates free to download in PDF, Word and Excel

941 Reconciliation Template Excel

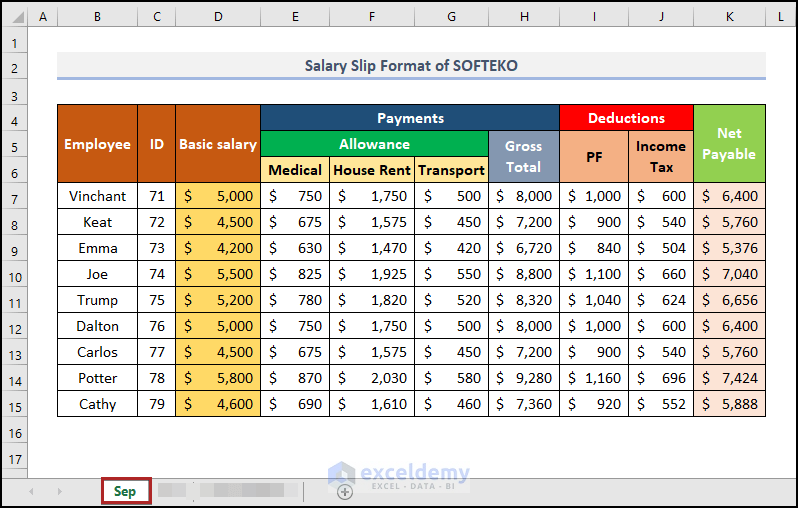

How to Do Payroll Reconciliation in Excel (with Easy Steps)

941 Reconciliation Template Excel

941 Reconciliation Template Excel

Account Reconciliation Template Excel SampleTemplatess SampleTemplatess

Related Post: