Asc 842 Excel Template

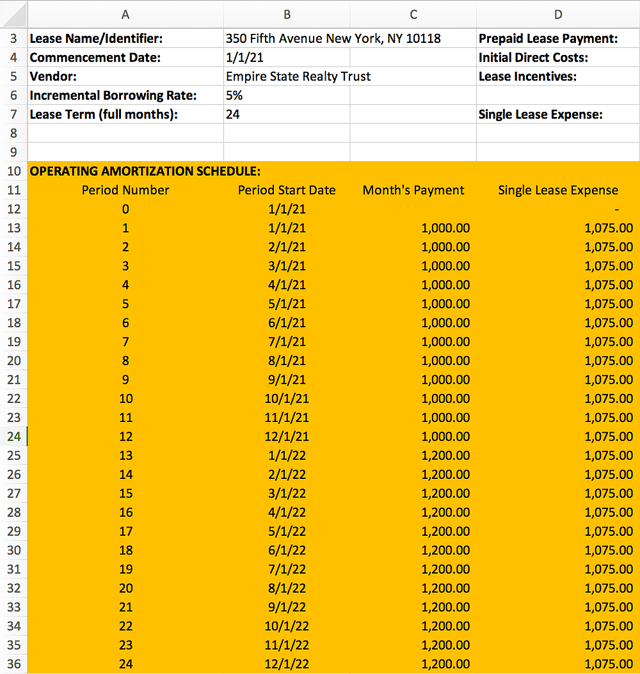

Asc 842 Excel Template - Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. Asc 842 effective dates effective date for public companies effective date for private companies. Those columns will be called date, lease liability, interest, payment, closing balance. Date lease payment interest liability reduction closing liability balance. Web how might your company’s inputs to the formula change when applying asc 842 guidance? Click the link to download a template for asc 842. Rate the rate component of the present value calculation is also. Web accounting for leases. Time is of the essence. Ad get powerful, streamlined insights into your company’s finances. What is a lease under asc 842? Date lease payment interest liability reduction closing liability balance. Asc 842 effective dates effective date for public companies effective date for private companies. The deadline for private companies to implement accounting standards. Web we unpack hot topics in lease accounting under asc 842 and considerations for entities that haven’t yet adopted the new. On february 25, 2016, fasb issued accounting standards update (asu) no. Ad get powerful, streamlined insights into your company’s finances. Rate the rate component of the present value calculation is also. Web download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842). Asc 842 effective dates. Ad get powerful, streamlined insights into your company’s finances. Web asc 842 lease classification test use this free tool to determine if your leases are classified as finance or operating leases under asc 842. The objective of this asu is. What is a lease under asc 842? Avoidance not an option for private companies: Click the link to download a template for asc 842. The deadline for private companies to implement accounting standards. The objective of this asu is. Web accounting for leases. Asc 842 effective dates effective date for public companies effective date for private companies. Click the link to download a template for asc 842. Embedded lease test use this. Time is of the essence. Rate the rate component of the present value calculation is also. On february 25, 2016, fasb issued accounting standards update (asu) no. Web asc 842 lease classification template for lessees what does our lease classification template cover? Deloitte’s lease accounting guide examines. On february 25, 2016, fasb issued accounting standards update (asu) no. Avoidance not an option for private companies: Web we unpack hot topics in lease accounting under asc 842 and considerations for entities that haven’t yet adopted the new standard. Ad get powerful, streamlined insights into your company’s finances. The objective of this asu is. Deloitte’s lease accounting guide examines. Read on to find out. On february 25, 2016, fasb issued accounting standards update (asu) no. Web the asc 842 lease accounting standard for gaap lease accounting requires all leases longer than 12 months to be recorded as assets and liabilities on. What is a lease under asc 842? Web since the goal of asc 842 is transparency, upon adoption, leases now need to be included on the balance sheet and reoccurring journal entries will be. Click the link to download a template for asc 842. The objective of this asu is. We’ve created an excel spreadsheet that walks you through the testing. Web asc 842 lease classification template for lessees what does our lease classification template cover? Web accounting for leases. Web since the goal of asc 842 is transparency, upon adoption, leases now need to be included on the balance sheet and reoccurring journal entries will be required. What is a lease under asc 842? Web larson lease accounting template asc 842. Embedded lease test use this. Click the link to download a template for asc 842. Web larson lease accounting template asc 842. Click the link to download a template for asc 842. Embedded lease test use this. Web download now with this lease amortization schedule you will be able to : The deadline for private companies to implement accounting standards. Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. On february 25, 2016, fasb issued accounting standards update (asu) no. Web accounting for leases. Web asc 842 lease classification test use this free tool to determine if your leases are classified as finance or operating leases under asc 842. Avoidance not an option for private companies: Web since the goal of asc 842 is transparency, upon adoption, leases now need to be included on the balance sheet and reoccurring journal entries will be required. Asc 842 effective dates effective date for public companies effective date for private companies. Web how might your company’s inputs to the formula change when applying asc 842 guidance? Web the asc 842 lease accounting standard for gaap lease accounting requires all leases longer than 12 months to be recorded as assets and liabilities on. Web we unpack hot topics in lease accounting under asc 842 and considerations for entities that haven’t yet adopted the new standard. Web download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842). The objective of this asu is. What is a lease under asc 842? Deloitte’s lease accounting guide examines. Rate the rate component of the present value calculation is also.Sensational Asc 842 Excel Template Dashboard Download Free

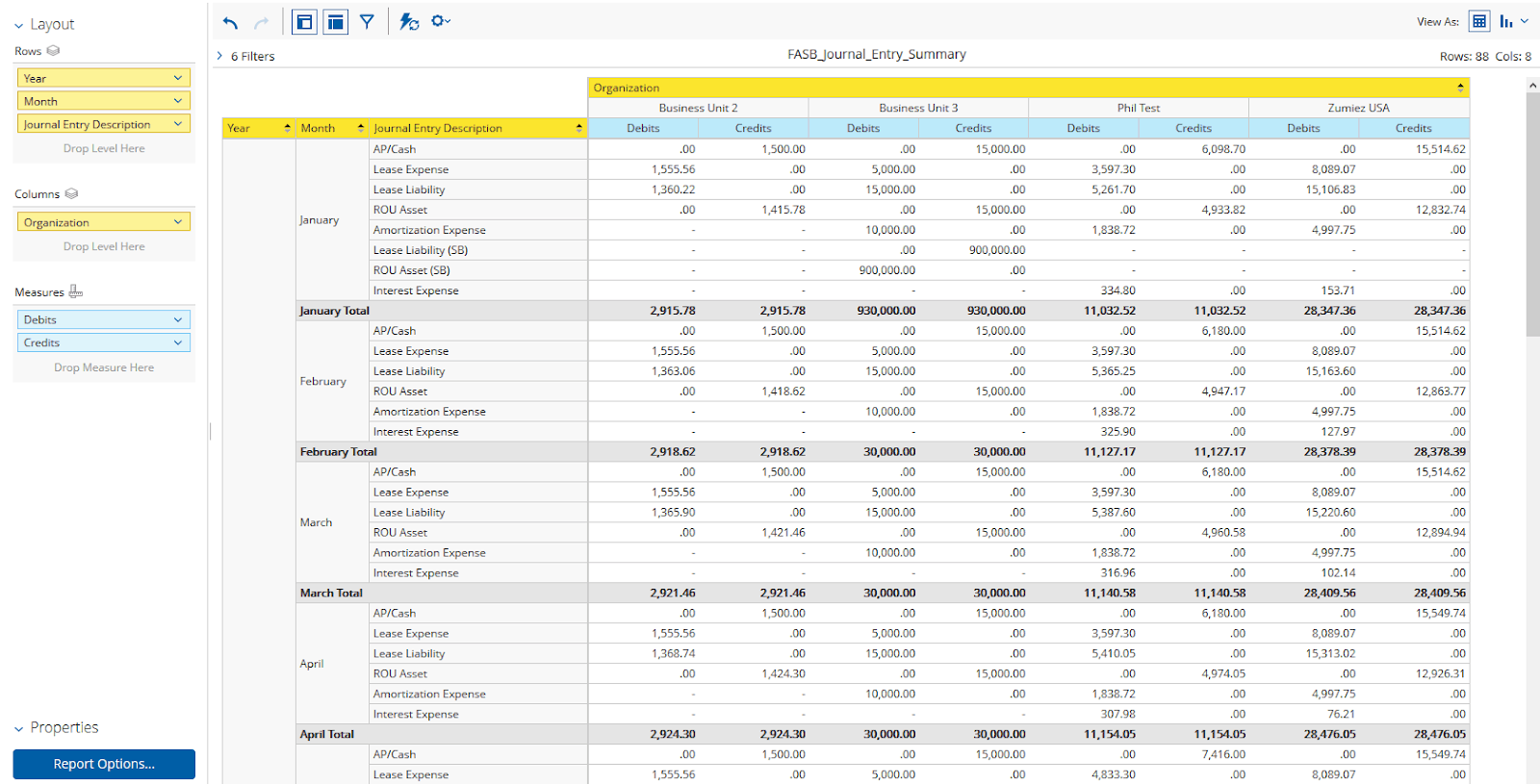

ASC 842 Journal Entries for Finance & Operating Leases Visual Lease

ASC 842 Excel Template Download

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

ASC 842 Guide

Lease Modification Accounting under ASC 842 Operating Lease to

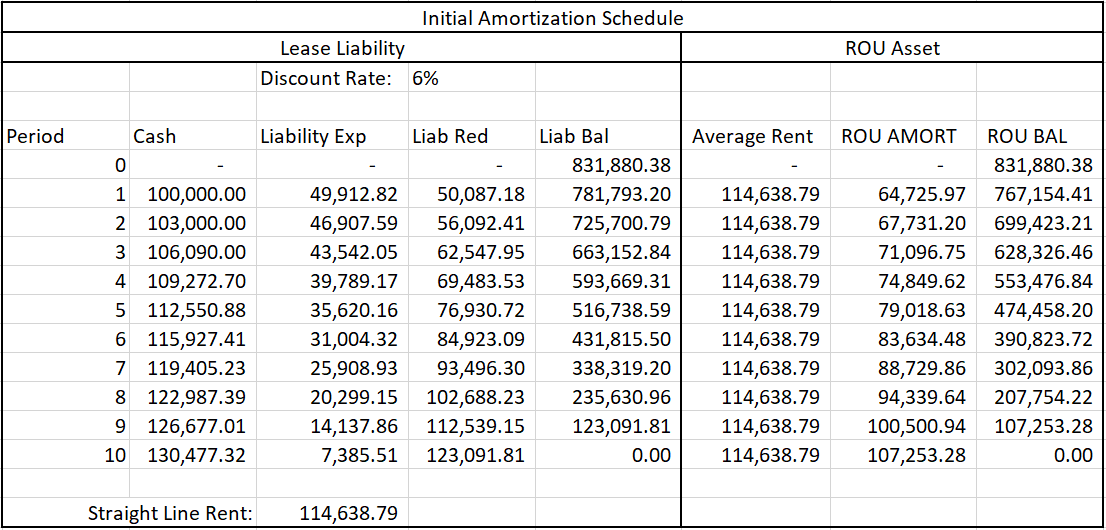

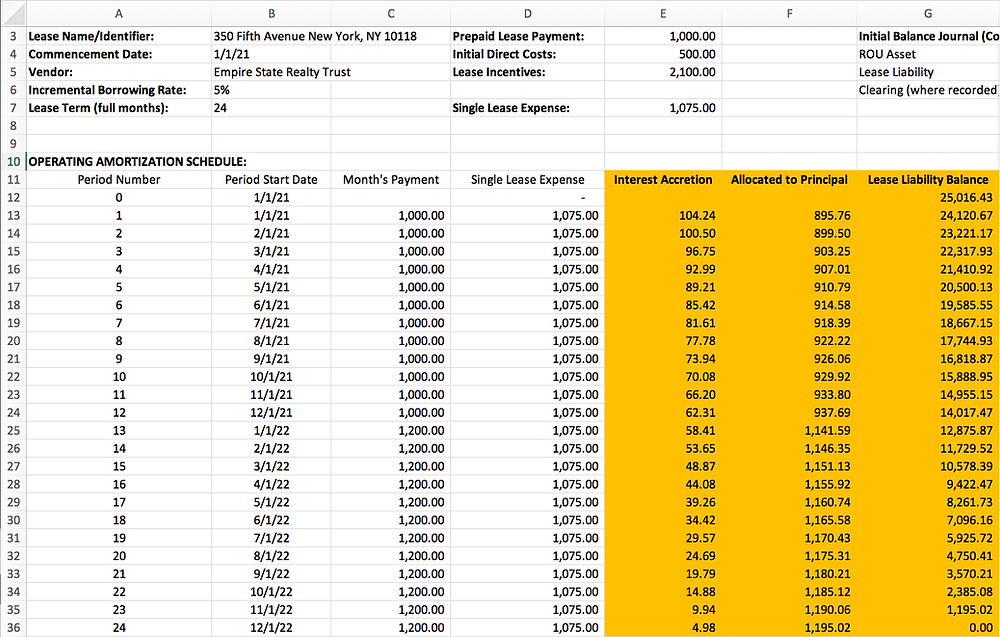

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Asc 842 Lease Accounting Excel Template

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Related Post: