Asc 842 Lease Amortization Schedule Template

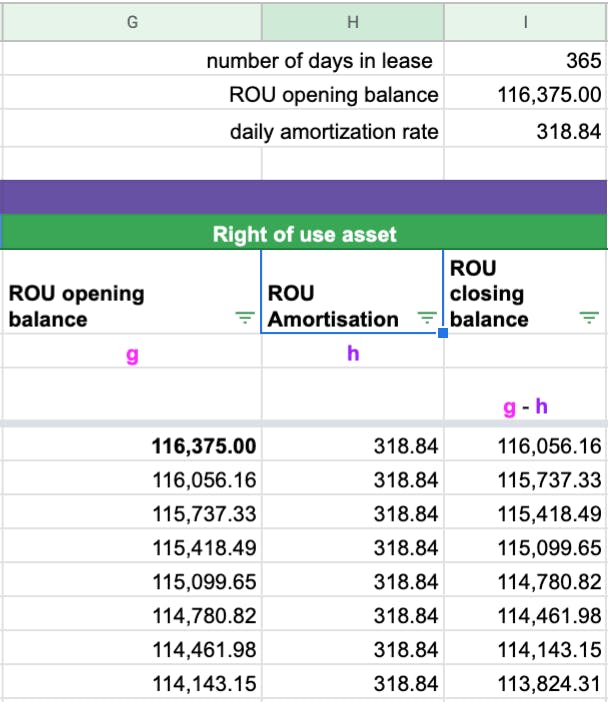

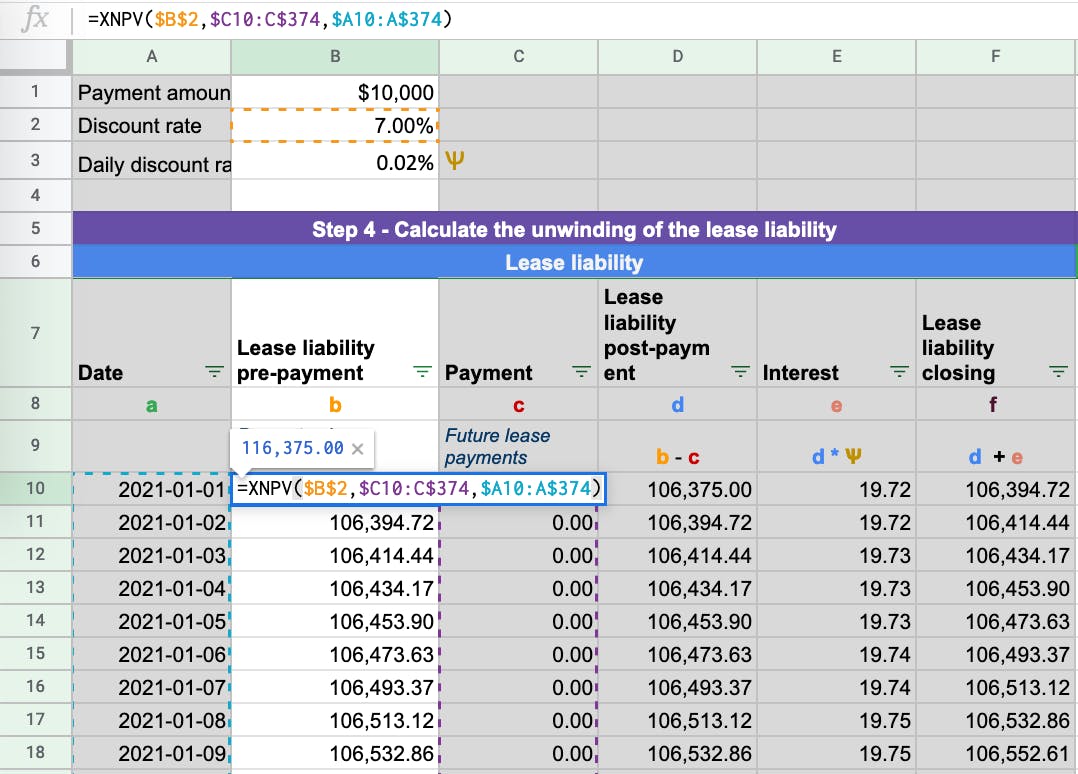

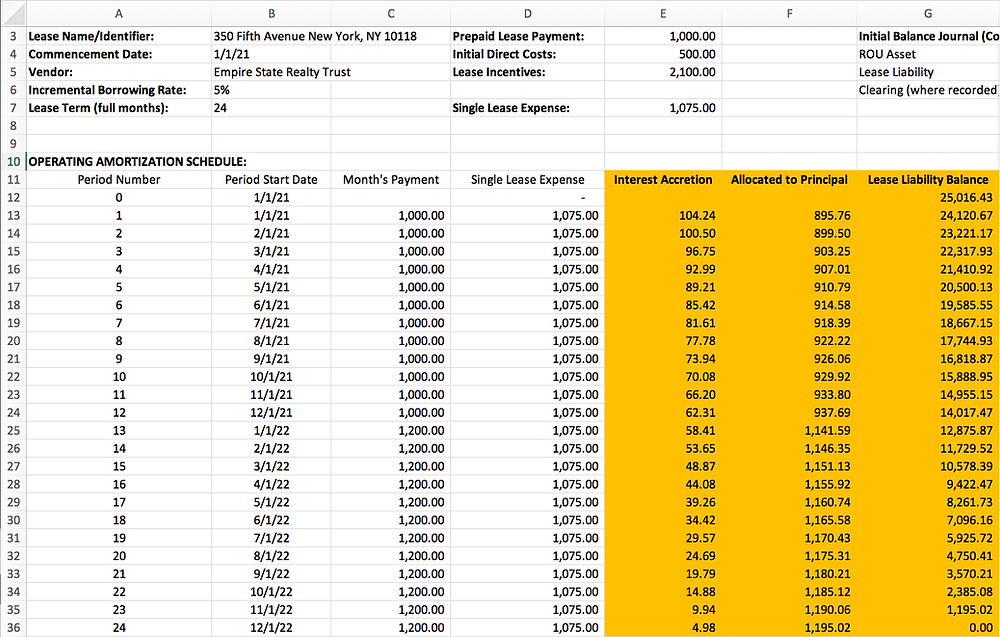

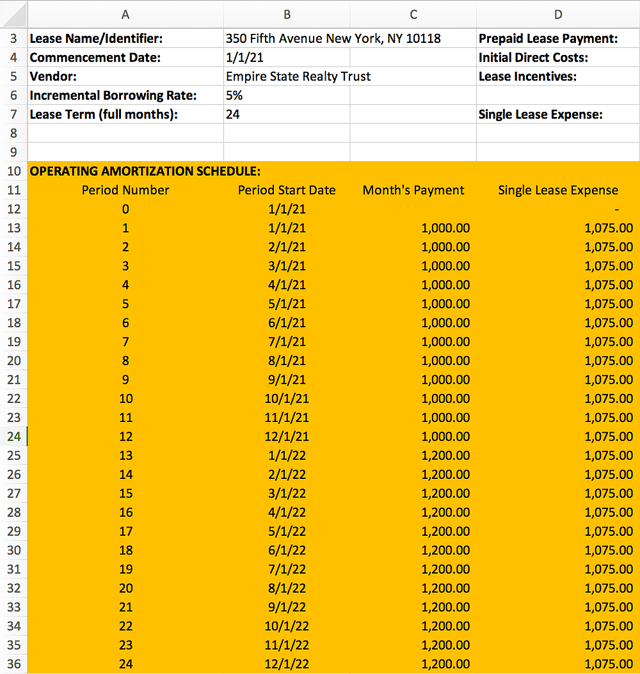

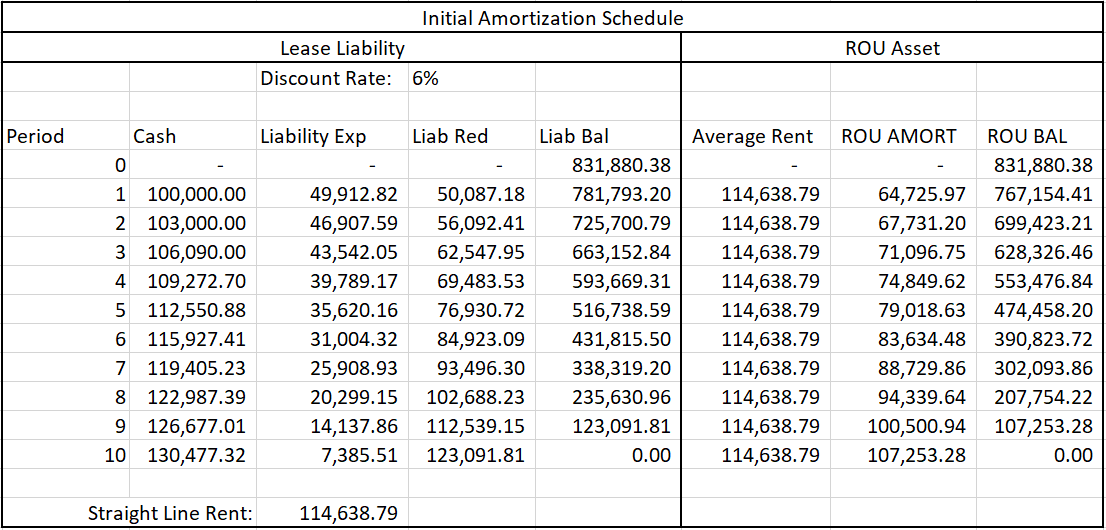

Asc 842 Lease Amortization Schedule Template - Web the amortization for a finance lease under asc 842 is very straightforward. Click the link to download a template for asc 842. Web the lease liability represents the future payments related to the lease. For a comprehensive discussion of. Web this solution will suffice for entities with around a dozen or less leases or a cpa firm validating client provided lease calculations. From this balance, the right of use asset is. Ad our software is backed by decades of lease accounting experience and trusted by experts. Ad lease accounting software that makes adopting the fasb asc lease accounting standard easy. Web download this asc 842 lease accounting spreadsheet template as we going you through how you capacity easily create an operating lease schedule that meets the. The entry to record the lease upon its commencement is a debit to rou asset and a credit to lease liability:. Debit of $112,000 under the rou asset. Asc 842 offers practical expedients that can be elected by certain entities or in certain arrangements. For a comprehensive discussion of. The user merely answers the lease and. Web in turn, your new asc 842 journal entries to recognize the commencement of this lease will be as follows: Web the amortization schedule for this lease is below. Web with this lease amortization schedule you will be able to : Asc 842 transition blueprint & workbook; At the end of each year, the company’s tax. Debit of $112,000 under the rou asset. Web in turn, your new asc 842 journal entries to recognize the commencement of this lease will be as follows: Ad lease accounting software that makes adopting the fasb asc lease accounting standard easy. From this balance, the right of use asset is. The lease liability balance will also be amortized to zero. Web learn more about lease accounting. Web asc 842 rules require the tia to be included as part of the rou asset and to be amortized over the term of the lease. Ad lease accounting software that makes adopting the fasb asc lease accounting standard easy. Web the following is the lease amortization schedule, prepared with the effective interest method, used to record the journal entries. Web asc 842 rules require the tia to be included as part of the rou asset and to be amortized over the term of the lease. Web with everything we’ve provided, we hope you have a better understanding of the new standards for lessees, are far less nervous about them now, and proceed with. Ad our software is backed by. The lease liability balance will also be amortized to zero. Web download our simple asc 842 compliant lease amortization schedule template. Ad our software is backed by decades of lease accounting experience and trusted by experts. Asc 842 transition blueprint & workbook; Web for each lease that is covered under 842 you’ll need to create an amortization schedule based on. Web for each lease that is covered under 842 you’ll need to create an amortization schedule based on the classification of the lease (finance or operating). Web the following is the lease amortization schedule, prepared with the effective interest method, used to record the journal entries under finance lease. Web the amortization schedule for this lease is below. The entry. From this balance, the right of use asset is. Web larson lease accounting template asc 842. Web download this asc 842 lease accounting spreadsheet template as we going you through how you capacity easily create an operating lease schedule that meets the. Debit of $112,000 under the rou asset. Automated lease accounting software for cpa firms that ensures compliance with. Web the following is the lease amortization schedule, prepared with the effective interest method, used to record the journal entries under finance lease. Web the amortization schedule for this lease is below. Web for each lease that is covered under 842 you’ll need to create an amortization schedule based on the classification of the lease (finance or operating). Web this. Using spreadsheets to comply with fasb's asc 842 and ifrs 16 is complex and difficult to. At the end of each year, the company’s tax. Asc 842 offers practical expedients that can be elected by certain entities or in certain arrangements. The lease liability balance will also be amortized to zero. Web the amortization for a finance lease under asc. Financing leases schedule and guide; Asc 842 offers practical expedients that can be elected by certain entities or in certain arrangements. Web larson lease accounting template asc 842. Web the following is the lease amortization schedule, prepared with the effective interest method, used to record the journal entries under finance lease. Web it's essentially like accounting for all your leases as if they were capital leases under asc 840. Ad our software is backed by decades of lease accounting experience and trusted by experts. For a comprehensive discussion of. Web in turn, your new asc 842 journal entries to recognize the commencement of this lease will be as follows: The lease liability balance will also be amortized to zero. Web this solution will suffice for entities with around a dozen or less leases or a cpa firm validating client provided lease calculations. Web the amortization schedule for this lease is below. Debit of $112,000 under the rou asset. Using spreadsheets to comply with fasb's asc 842 and ifrs 16 is complex and difficult to. The entry to record the lease upon its commencement is a debit to rou asset and a credit to lease liability:. Web asc 842 rules require the tia to be included as part of the rou asset and to be amortized over the term of the lease. Web with everything we’ve provided, we hope you have a better understanding of the new standards for lessees, are far less nervous about them now, and proceed with. Automated lease accounting software for cpa firms that ensures compliance with asc 842. Web for each lease that is covered under 842 you’ll need to create an amortization schedule based on the classification of the lease (finance or operating). Ad lease accounting software that makes adopting the fasb asc lease accounting standard easy. Web with this lease amortization schedule you will be able to :How to Calculate the Lease Liability and RightofUse (ROU) Asset for

ASC 842 Guide

How to Calculate a Finance Lease under ASC 842

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

How to Calculate a Finance Lease under ASC 842

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Sensational Asc 842 Excel Template Dashboard Download Free

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Lease Modification Accounting under ASC 842 Operating Lease to

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Related Post: