Asc 842 Lease Template Excel

Asc 842 Lease Template Excel - On february 25, 2016, the fasb issued accounting standards update no. A lease liability is required to be. Click the link to download a template for asc 842. Outlined below are the components of. Determine the total lease payments under gaap. Web what is asc 842? Web fasb asc 842 is applicable to any entity that enters into a lease and applies to all leases and subleases of property, plant, and equipment; Web the basic 842lease.com excel spreadsheet and the powerful vba based 842ware for lessees©. Web how to use excel to calculate lease liabilities. Lease accounting is like a tale of two cities, with companies that have adopted asc 842. Ad download all types of official state by state rental lease agreements. What is a lease under asc 842? Determine the lease term under asc 840. Web asc 842 embedded lease assessment template for lessees. Web how to calculate a lease liability using excel. Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. The basic 842lease.com spreadsheet is designed to be very simple and user. Web how to calculate a lease liability using excel. Lease accounting is like a tale of two cities, with companies that have adopted asc 842. Web fasb asc 842. Web the asc 842 leasing standard. Create, save & print yours now. Determine the lease term under asc 840. Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. Web fasb asc 842 is applicable to any entity that enters into a lease and applies to all leases and subleases of. Web what is asc 842? Effective date for public companies. Web the basic 842lease.com excel spreadsheet and the powerful vba based 842ware for lessees©. Web fasb asc 842 is applicable to any entity that enters into a lease and applies to all leases and subleases of property, plant, and equipment; Web asc 842 lease classification test. On february 25, 2016, the fasb issued accounting standards update no. Use this free tool to determine if your leases are classified as finance or operating leases under asc 842. The basic 842lease.com spreadsheet is designed to be very simple and user. Web fasb asc 842 is applicable to any entity that enters into a lease and applies to all. Click the link to download a template for asc 842. A lease liability is required to be. Web with everything we’ve provided, we hope you have a better understanding of the new standards for lessees, are far less nervous about them now, and proceed with. On february 25, 2016, the fasb issued accounting standards update no. Web excel templates for. Lease accounting is like a tale of two cities, with companies that have adopted asc 842. Web with everything we’ve provided, we hope you have a better understanding of the new standards for lessees, are far less nervous about them now, and proceed with. Web the basic 842lease.com excel spreadsheet and the powerful vba based 842ware for lessees©. Web excel. Get powerful, streamlined insights into your company’s finances. The lease liability is the present value of the known future lease payments at a point in time. On february 25, 2016, the fasb issued accounting standards update no. The basic 842lease.com spreadsheet is designed to be very simple and user. Web what is asc 842? Web with everything we’ve provided, we hope you have a better understanding of the new standards for lessees, are far less nervous about them now, and proceed with. Web the asc 842 leasing standard. The basic 842lease.com spreadsheet is designed to be very simple and user. On february 25, 2016, the fasb issued accounting standards update no. Web how to. Effective date for private companies. Web the basic 842lease.com excel spreadsheet and the powerful vba based 842ware for lessees©. Web what is asc 842? Lease accounting is like a tale of two cities, with companies that have adopted asc 842. On february 25, 2016, the fasb issued accounting standards update no. Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. Web asc 842 lease classification test. While we try not to be alarmists here at embark, sometimes the fine people at the fasb (financial. Get powerful, streamlined insights into your company’s finances. Determine the total lease payments under gaap. Effective date for private companies. Ad download all types of official state by state rental lease agreements. Answer simple questions to make an equipment lease on any device in minutes. Web how to calculate a lease liability using excel. What is a lease under asc 842? Use this free tool to determine if your leases are classified as finance or operating leases under asc 842. The lease liability is the present value of the known future lease payments at a point in time. Get powerful, streamlined insights into your company’s finances. Effective date for public companies. Web fasb asc 842 is applicable to any entity that enters into a lease and applies to all leases and subleases of property, plant, and equipment; Web details on the example lease agreement. Web larson lease accounting template asc 842. Web asc 842 embedded lease assessment template for lessees. Click the link to download a template for asc 842. On february 25, 2016, the fasb issued accounting standards update no.Asc 842 Lease Template Excel

ASC 842 Guide

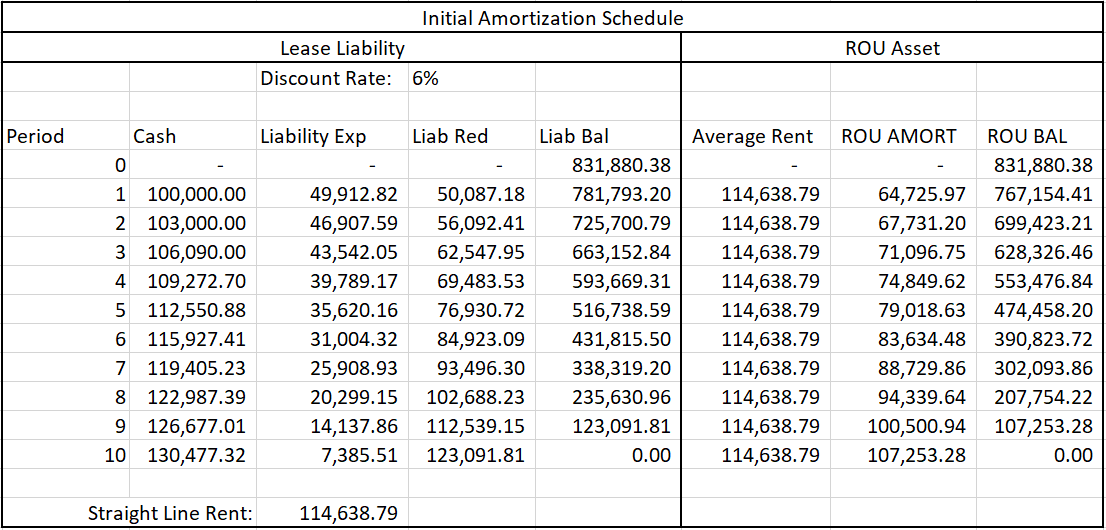

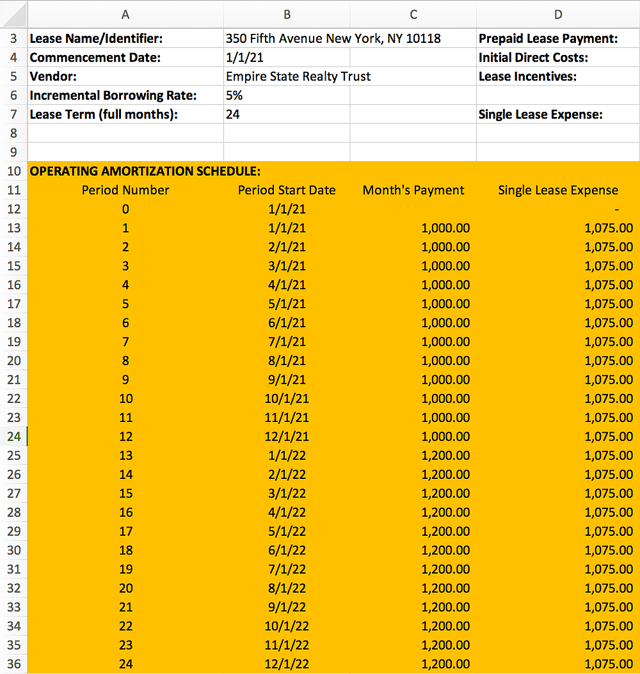

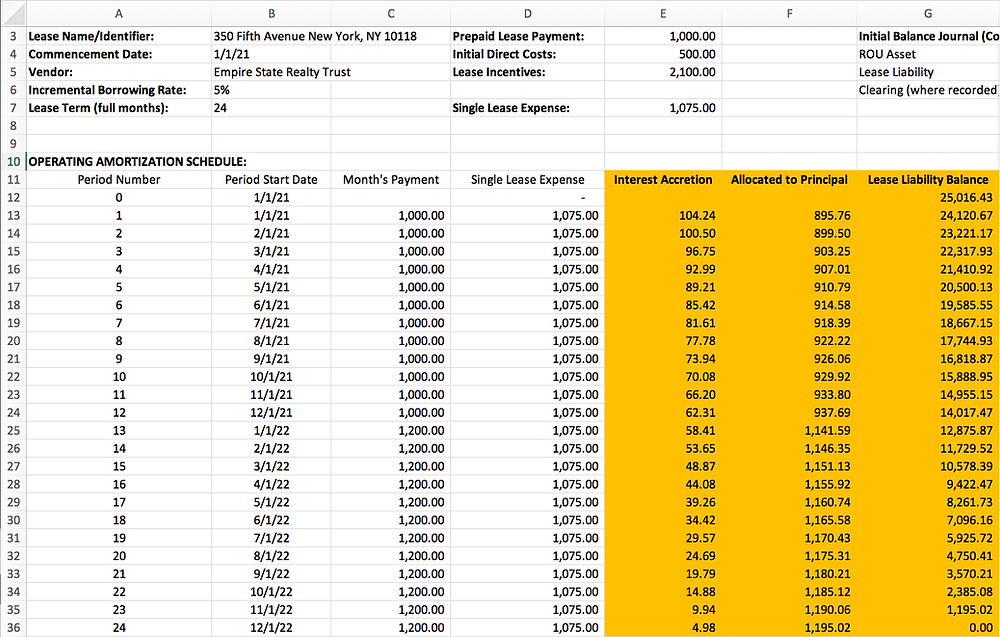

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

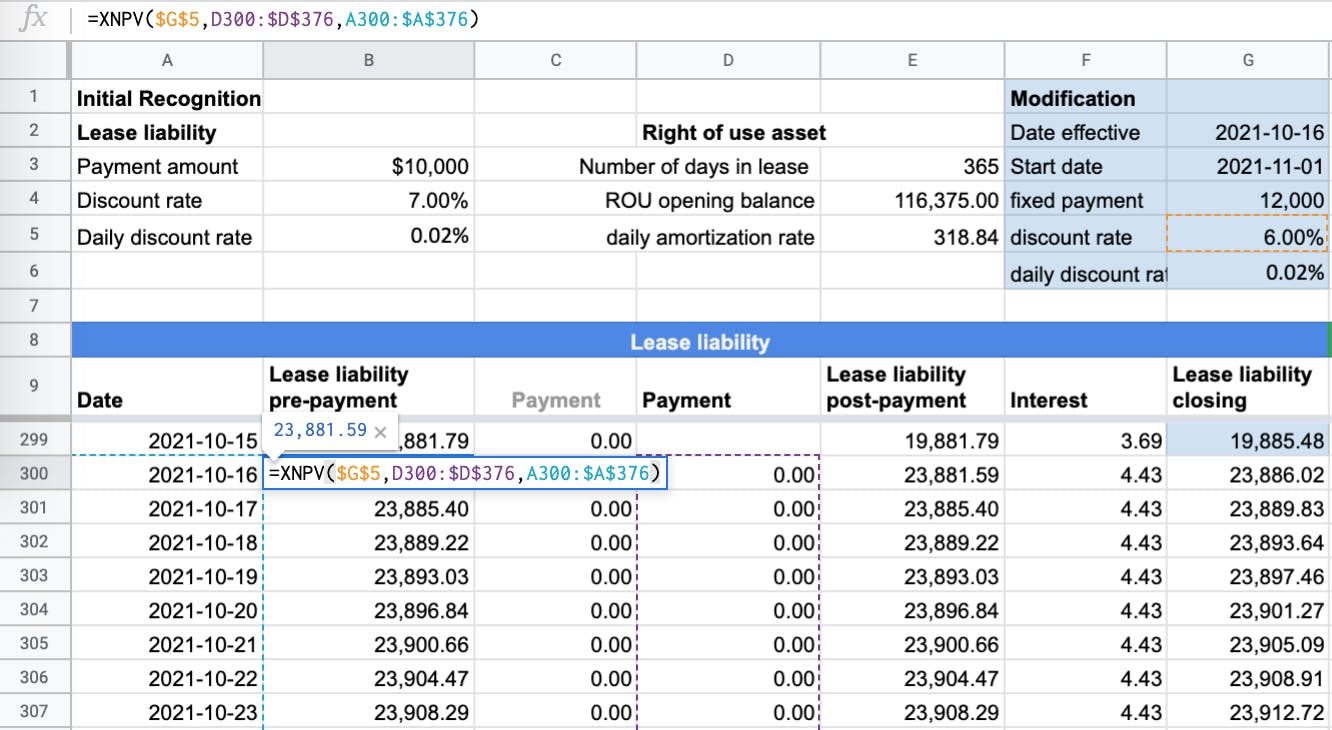

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

How to Calculate a Finance Lease under ASC 842

Sensational Asc 842 Excel Template Dashboard Download Free

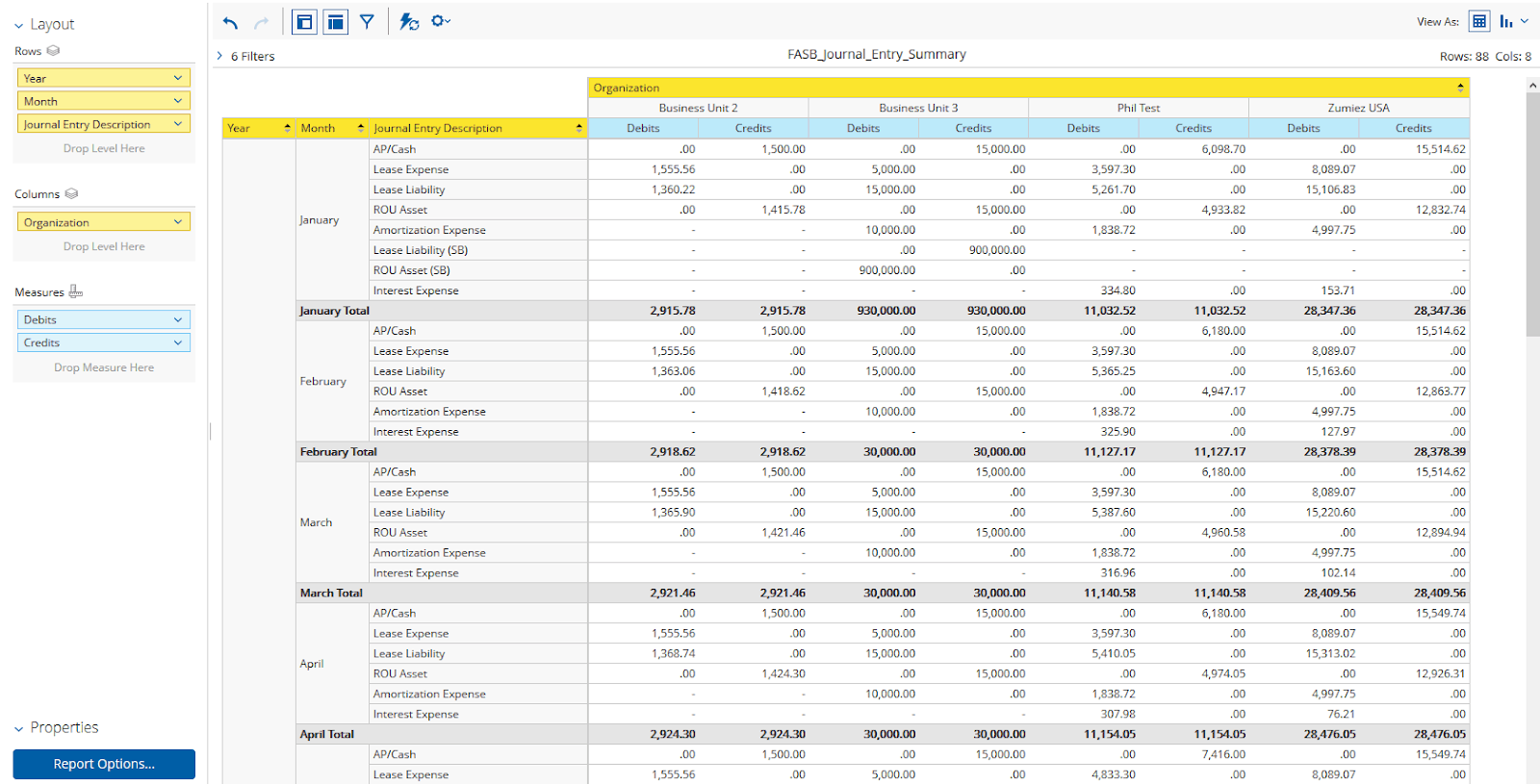

ASC 842 Journal Entries for Finance & Operating Leases Visual Lease

Lease Modification Accounting under ASC 842 Operating Lease to

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Related Post: