Daily Compound Interest Calculator Excel Template

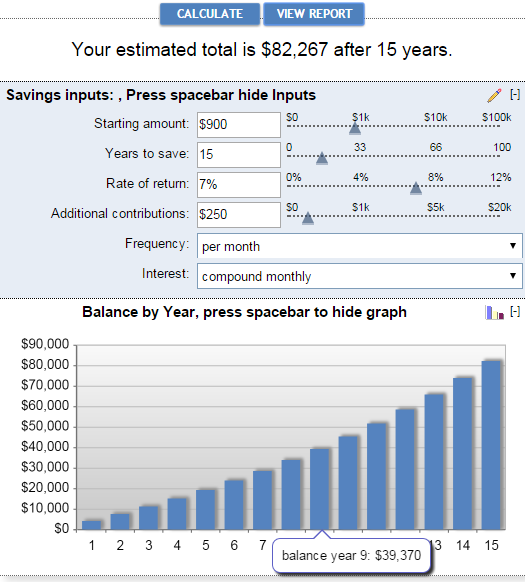

Daily Compound Interest Calculator Excel Template - Web download a daily compounding loan calculator for excel to analyze a loan or credit card based on daily compounding interest. Web p ’ =p (1+r/n)^nt. Pmt calculates the payment for a loan based on constant payments and a constant interest rate. R is the interest rate. P is the principal or the initial investment. In the above example, with $10000 of principal amount and 10%. A = p * (1 + r / n) ^ (n * t) a is the value of an investment in the future. Web use the following functions: Current balance = present amount * (1 + interest rate)^n. Web =p* (1+ (k/m))^ (m*n) where the following is true: Daily interest calculation for compound interest in excel. All we did was multiplying 100 by 1.08, 5 times. P' is the gross amount (after the interest is applied). In the above example, with $10000 of principal amount and 10%. Web =principal amount*((1+annual interest rate/1)^(total years of investment *1))) let me show you an example. Web as a result, the interest earned over time can be much higher than simple interest, which only calculates interest on the initial amount. Daily interest calculation for compound interest in excel. Pmt calculates the payment for a loan based on constant payments and a constant interest rate. Nper calculates the number of payment periods. All we did was multiplying. Daily interest calculation for compound interest in excel. Before we discuss the daily compound interest calculator in excel, we should know the basic compound interest formula. M = number of times per period (typically months) the interest is compounded. Daily compound interest formula in excel. K = annual interest rate paid. Web download a daily compounding loan calculator for excel to analyze a loan or credit card based on daily compounding interest. Current balance = present amount * (1 + interest rate)^n. Web as a result, the interest earned over time can be much higher than simple interest, which only calculates interest on the initial amount. Compound interest is a concept. If you’re investing or saving money in a bank, compound interest is the. The basic compound interest formula is shown below: M = number of times per period (typically months) the interest is compounded. Which is the same as: P' is the gross amount (after the interest is applied). N is the number of. Beginning value x [1 + (interest rate ÷ number of compounding periods per year)] ^ (years x number of compounding periods per year) =. Web this is a guide to daily compound interest formula. Before we discuss the daily compound interest calculator in excel, we should know the basic compound interest formula. Daily interest calculation. So we can also directly calculate the value of the investment after 5 years. The basic compound interest formula is shown below: Current balance = present amount * (1 + interest rate)^n. See how much daily interest/earnings you. P' is the gross amount (after the interest is applied). Here we have discussed how to calculate daily compound, practical examples, and a downloadable. A = p * (1 + r / n) ^ (n * t) a is the value of an investment in the future. Beginning value x [1 + (interest rate ÷ number of compounding periods per year)] ^ (years x number of compounding periods per year). See how much daily interest/earnings you. All we did was multiplying 100 by 1.08, 5 times. Pmt calculates the payment for a loan based on constant payments and a constant interest rate. Daily interest calculation for compound interest in excel. K = annual interest rate paid. Web use the following functions: Web as a result, the interest earned over time can be much higher than simple interest, which only calculates interest on the initial amount. N is the number of. Current balance = present amount * (1 + interest rate)^n. Web the formula for creating a daily compound interest calculator excel spreadsheet is: Web this is a guide to daily compound interest formula. K = annual interest rate paid. P' is the gross amount (after the interest is applied). Web download a daily compounding loan calculator for excel to analyze a loan or credit card based on daily compounding interest. N is the number of. Daily compound interest formula in excel. Web =principal amount*((1+annual interest rate/1)^(total years of investment *1))) let me show you an example. The basic compound interest formula is shown below: Web as a result, the interest earned over time can be much higher than simple interest, which only calculates interest on the initial amount. Daily interest calculation for compound interest in excel. P is the principal or the initial investment. Calculate daily interest in excel to find simple interest. Ad get powerful, streamlined insights into your company’s finances. Here, n= number of periods. M = number of times per period (typically months) the interest is compounded. Nper calculates the number of payment periods. R is the interest rate. If you’re investing or saving money in a bank, compound interest is the. See how much daily interest/earnings you. Which is the same as:A Daily Compound Interest Calculator in Excel (Template Attached)

Calculate compound interest in Excel formula and calculator (2022)

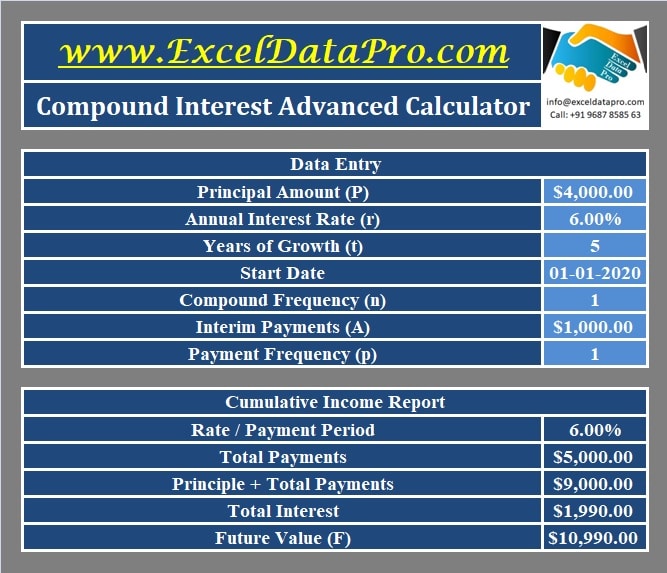

Download Compound Interest Calculator Excel Template ExcelDataPro

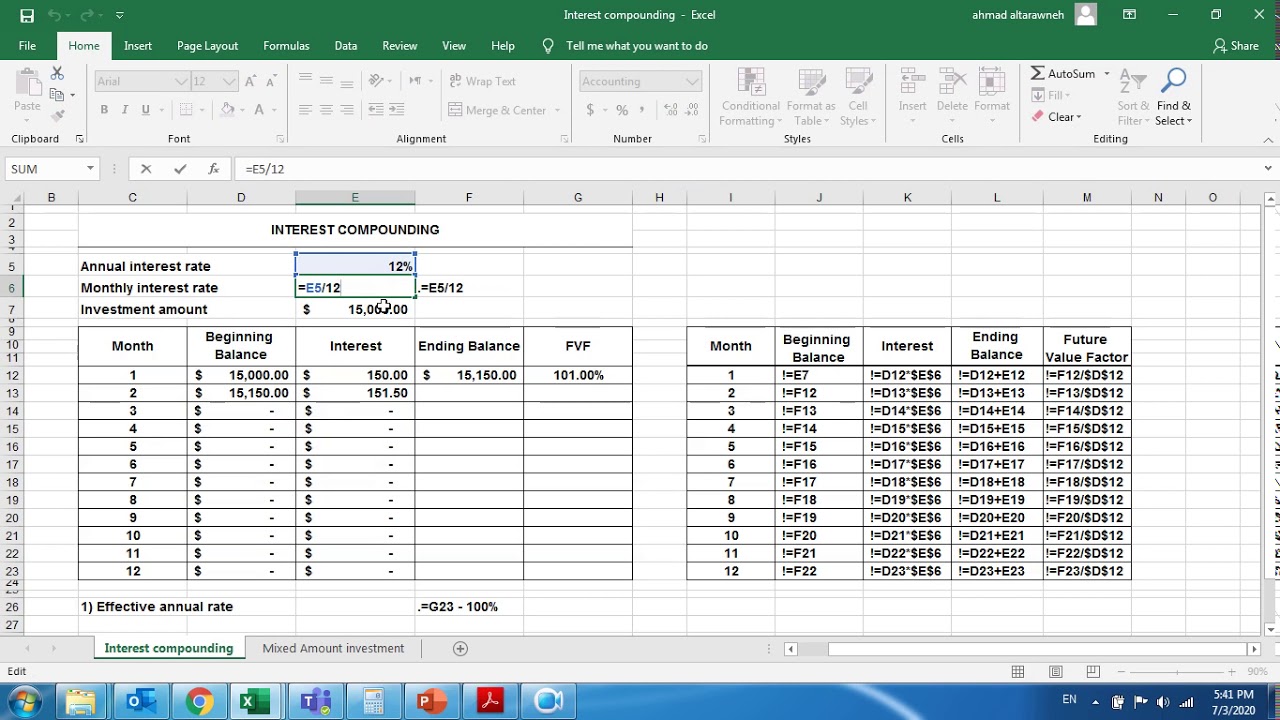

Interest compounding By using Microsoft Excel YouTube

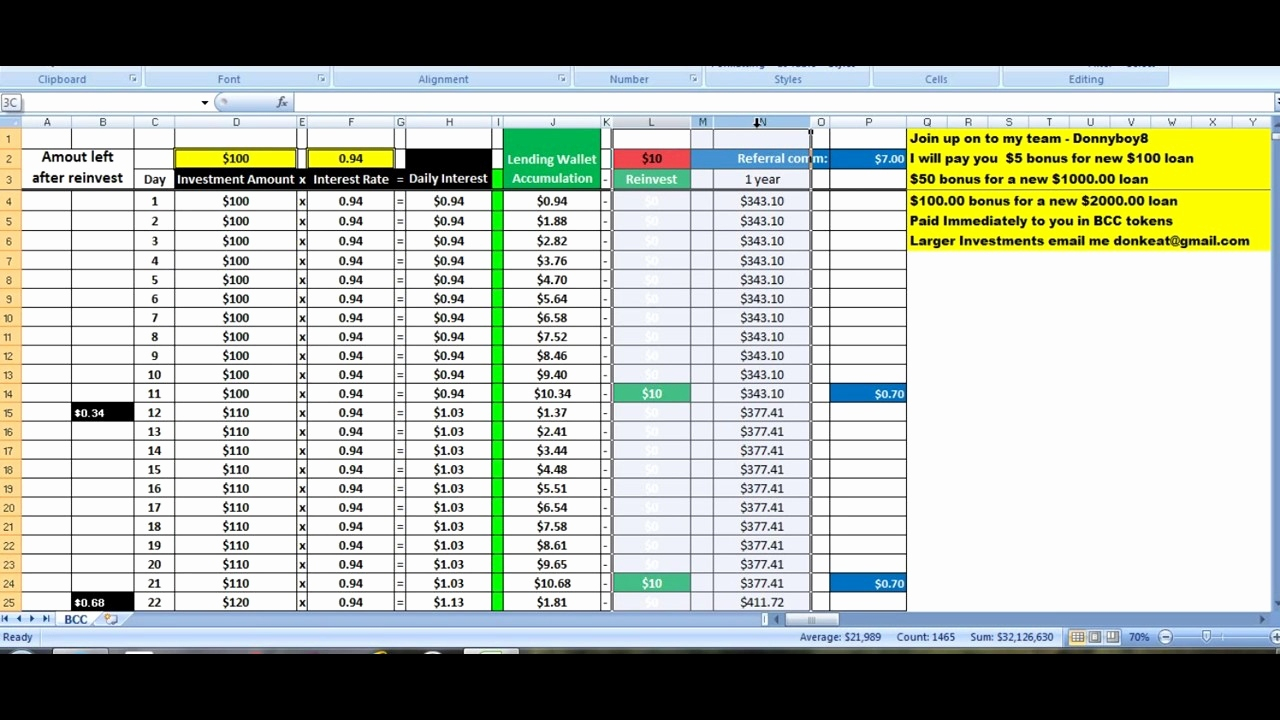

Compound Interest Spreadsheet within Compound Interest Calculator Excel

Finance Basics 2 Compound Interest in Excel YouTube

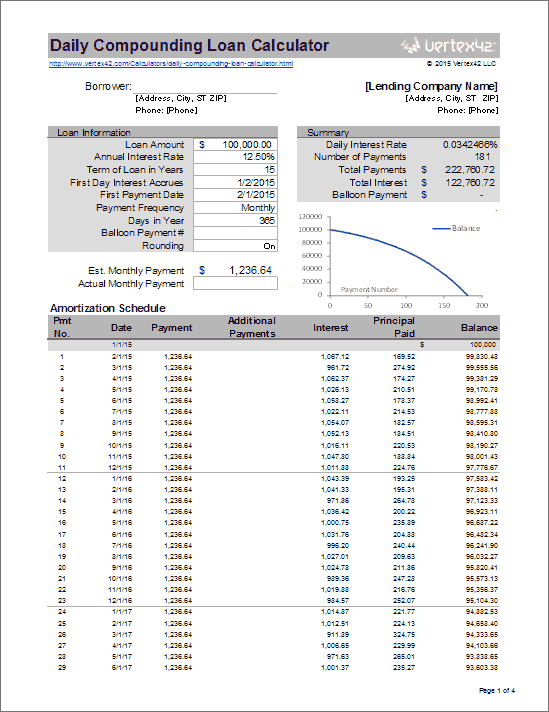

Daily Compounding Loan Calculator

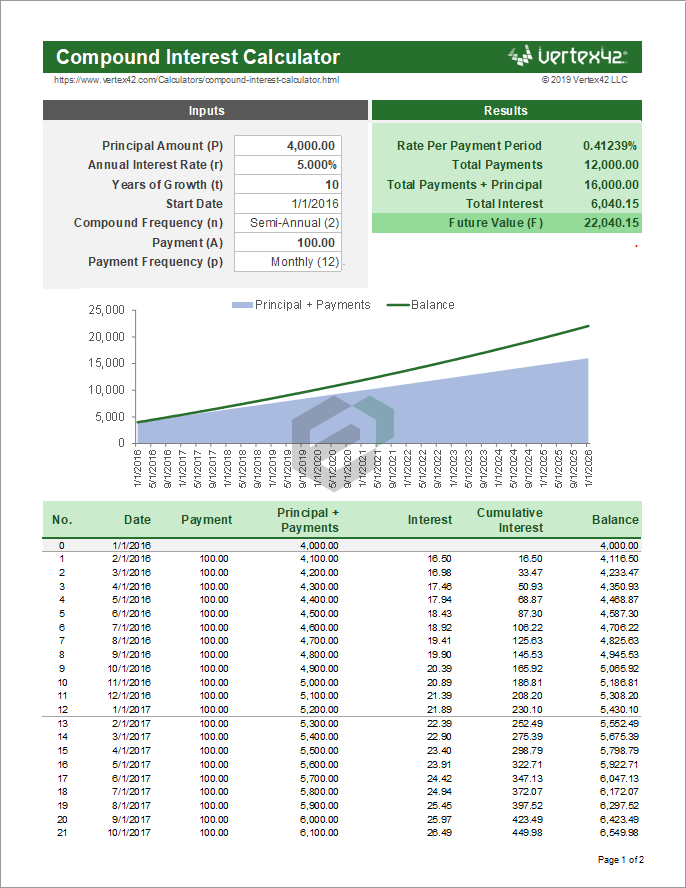

Compound Interest Calculator Template in Excel & Spreadsheet

How to Make a Compound Interest Calculator in Microsoft Excel by

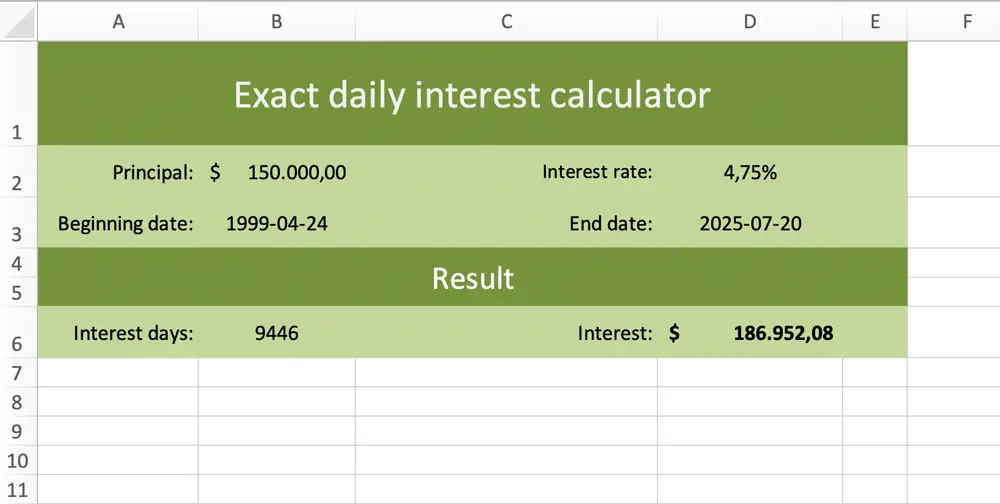

Exact interest calculator as a free Excel template

Related Post: