Dave Ramsey Debt Snowball Template

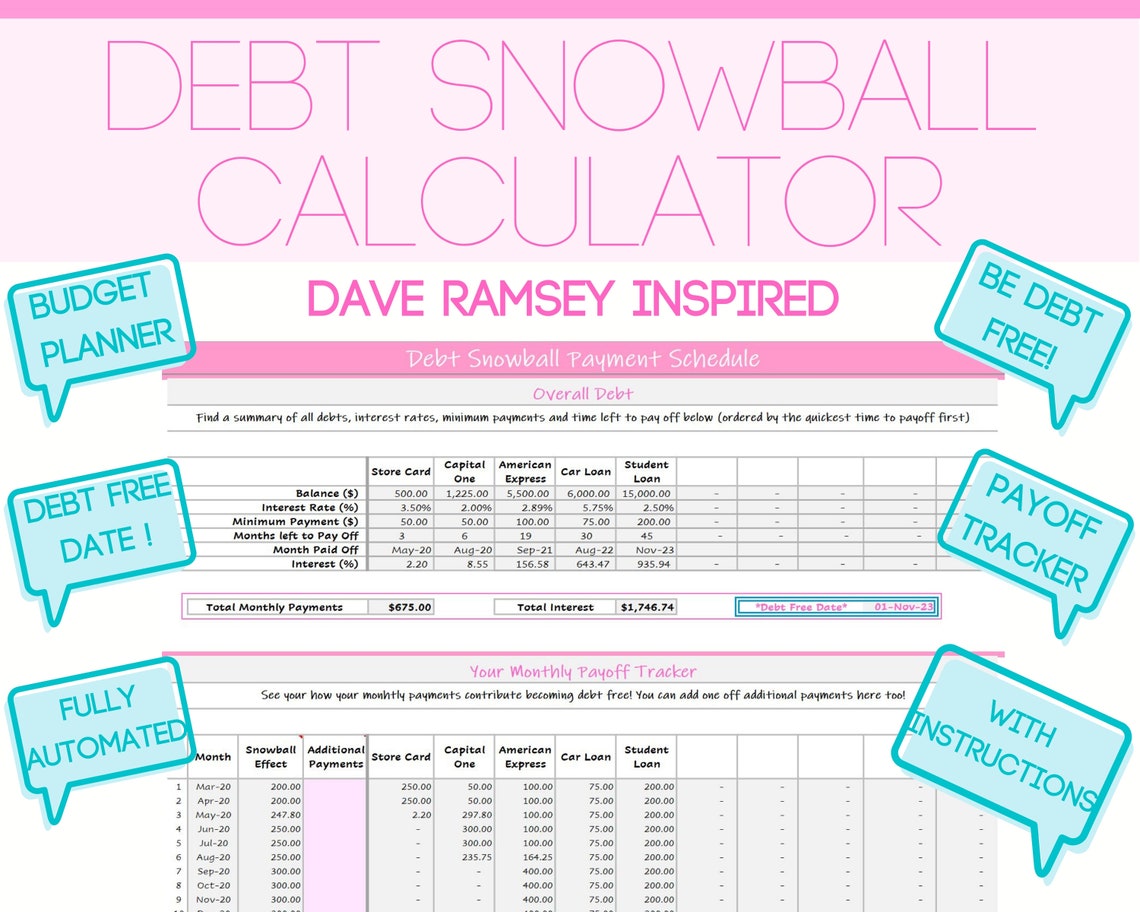

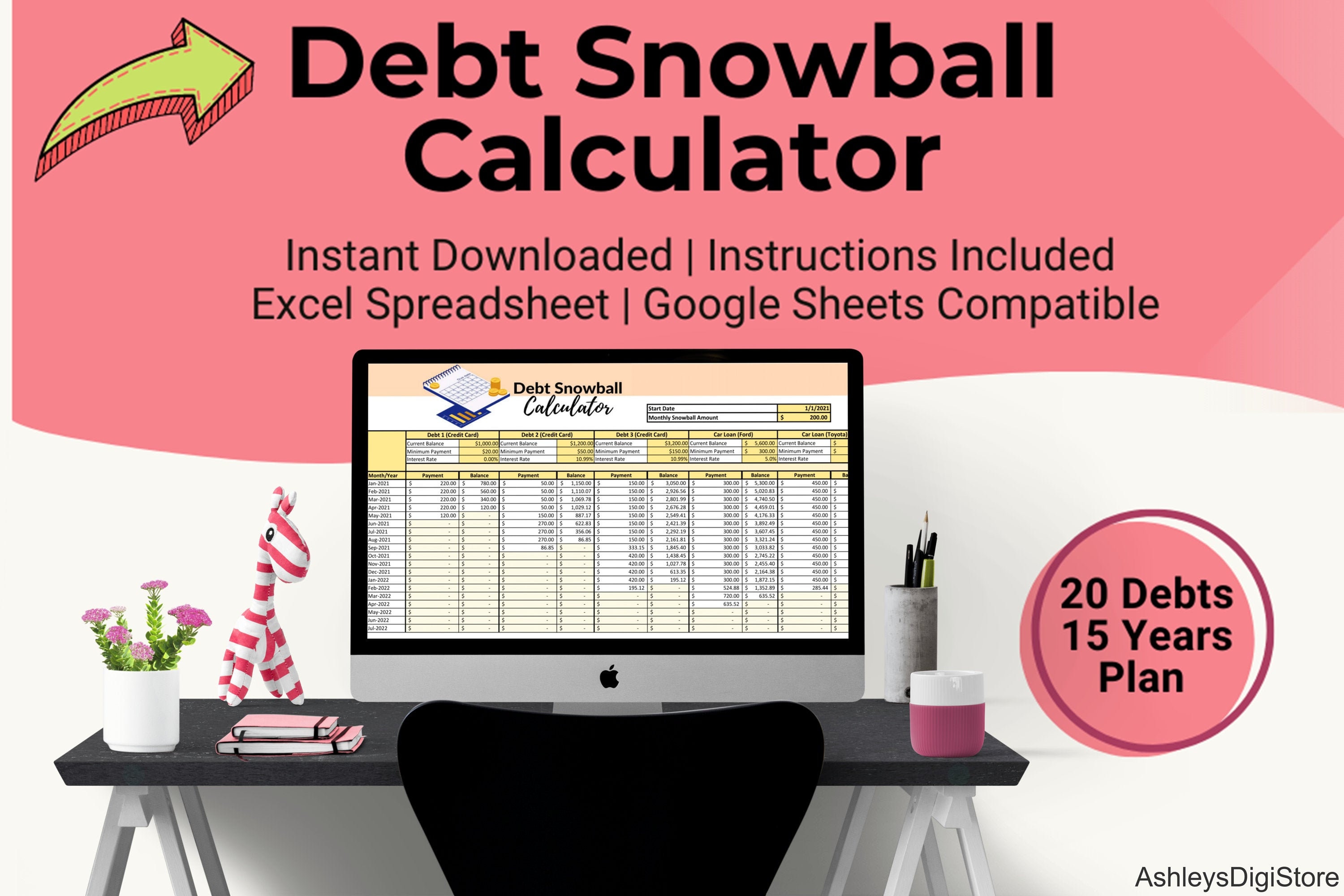

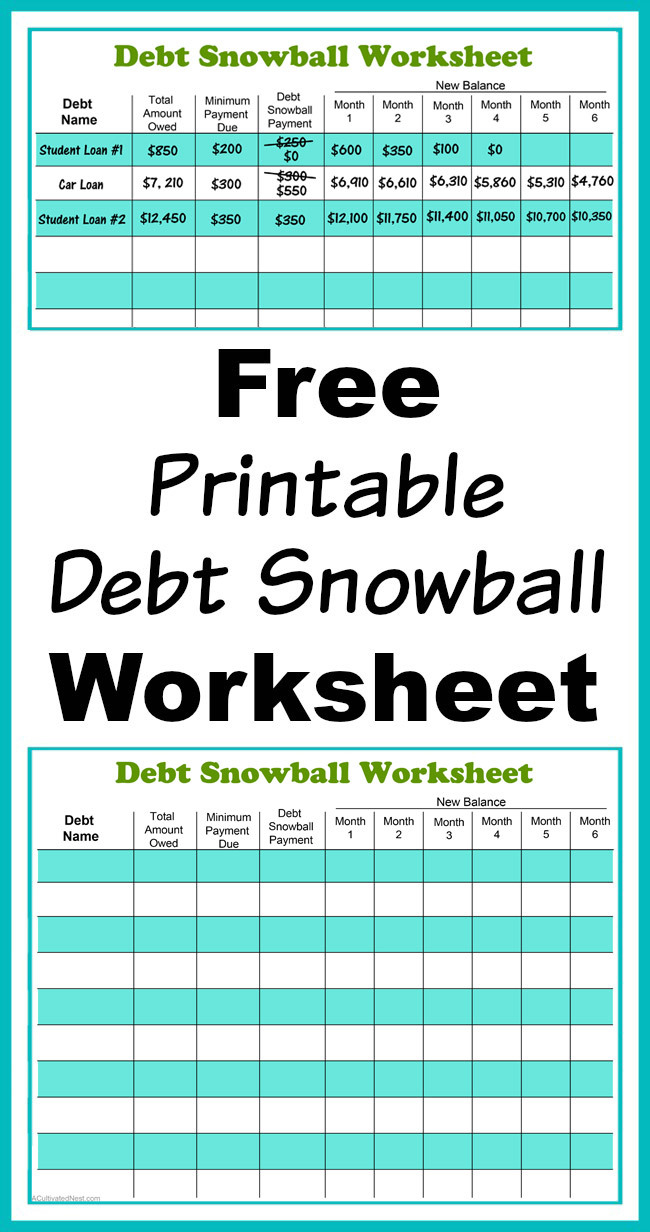

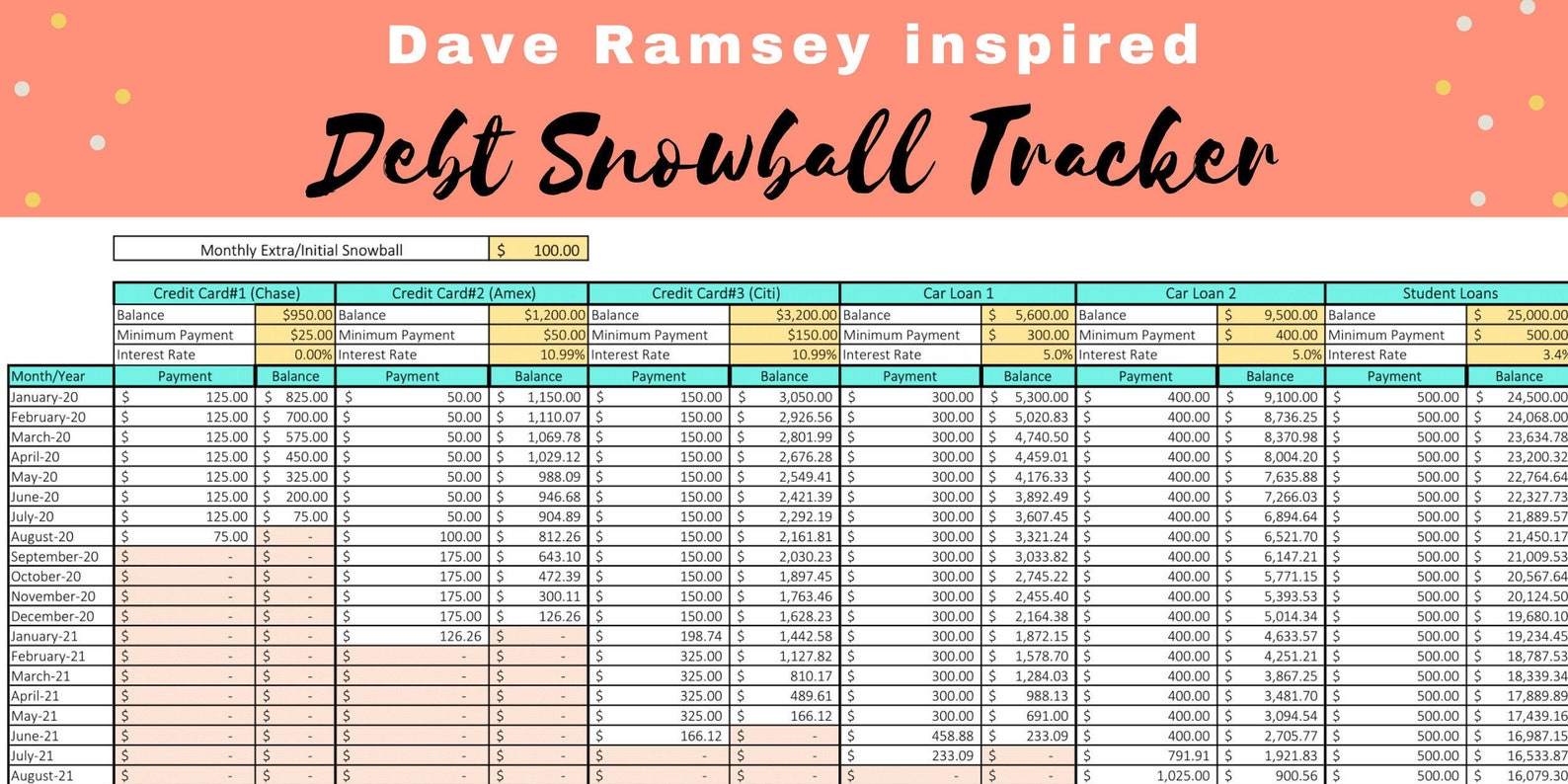

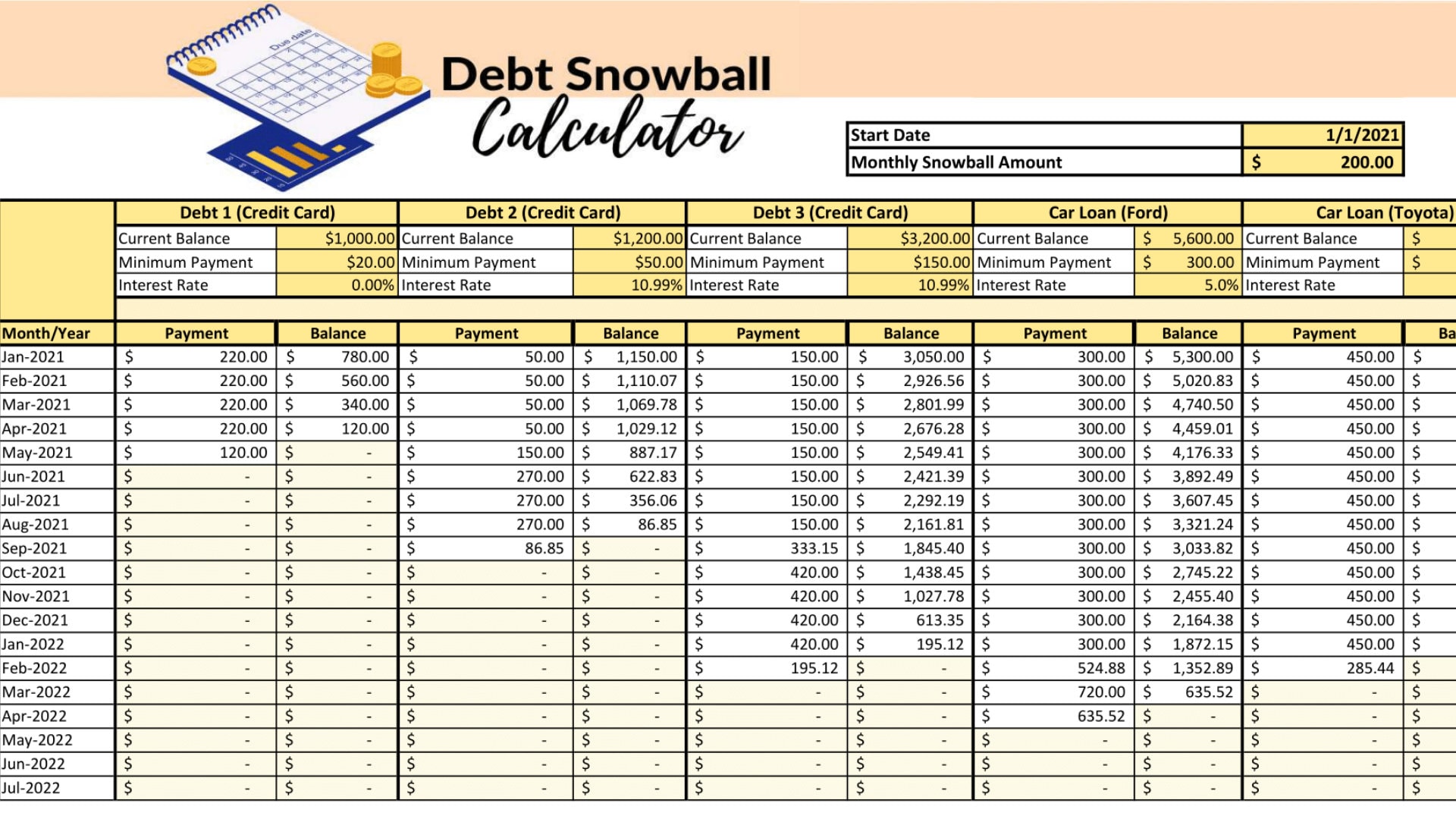

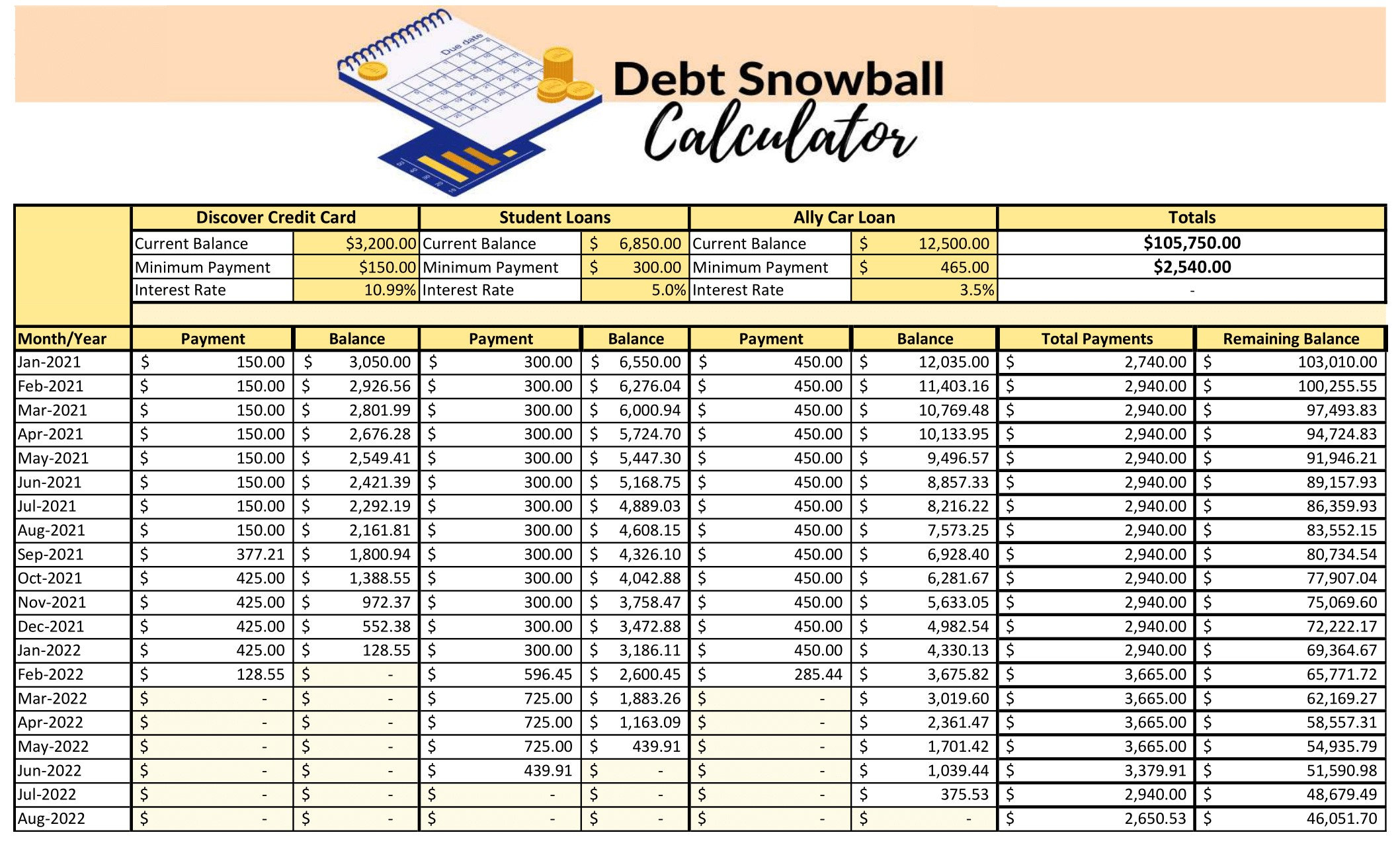

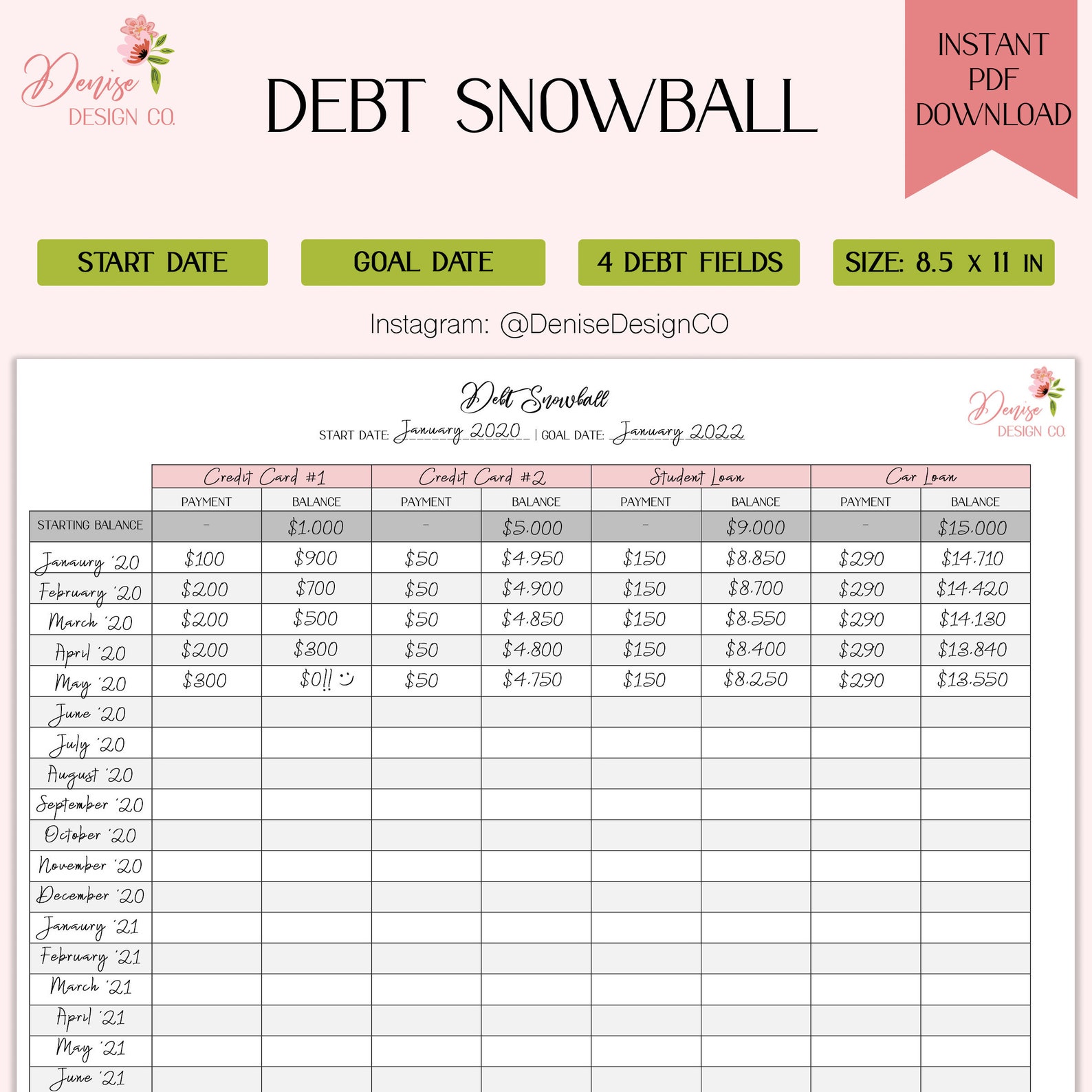

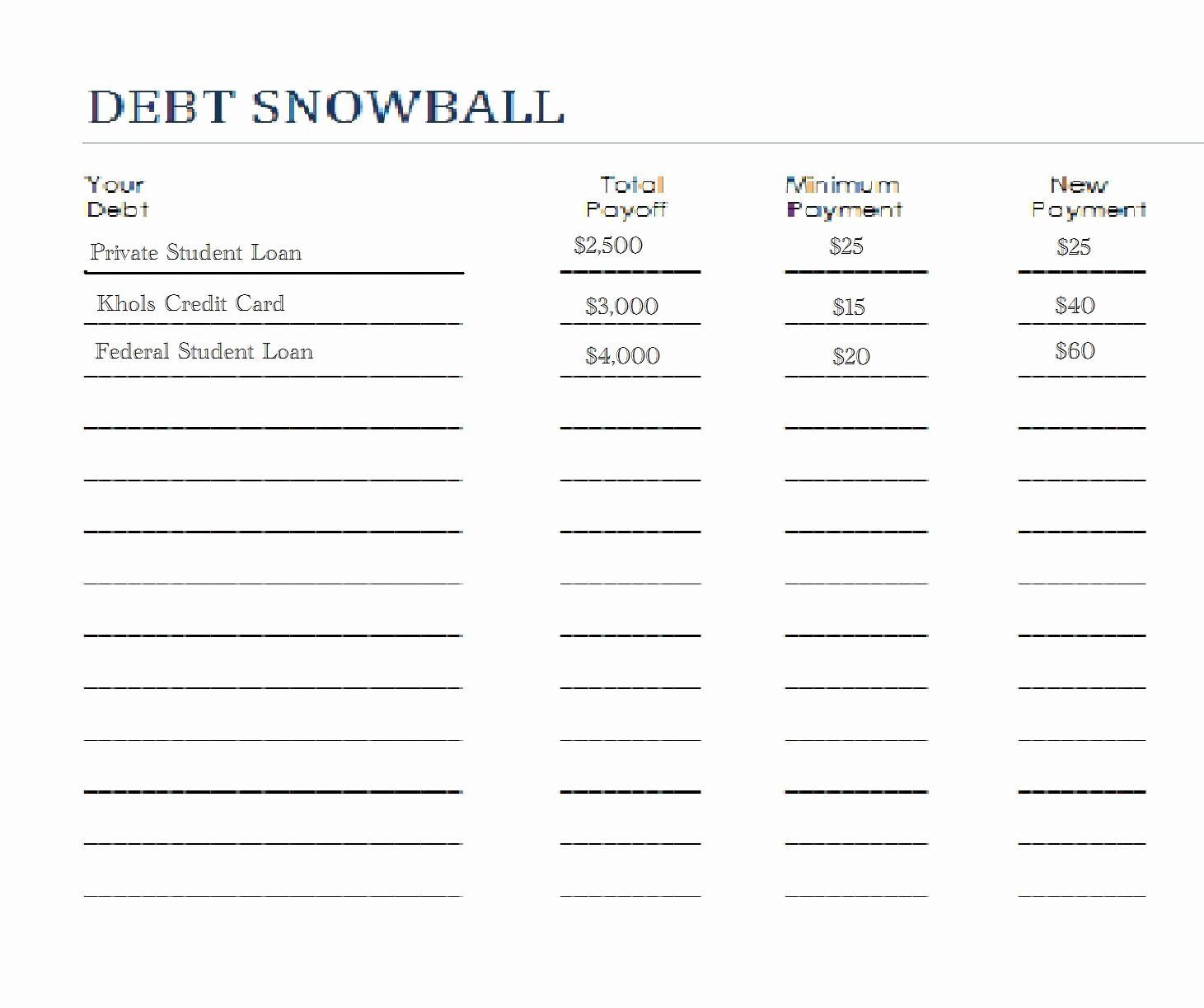

Dave Ramsey Debt Snowball Template - Web dave ramsey debt snowball calculator! Web the debt snowball method is the best way to get out of debt. Jan feb mar 100% 10% Here are the basic steps if the debt snowball method. But before you adopt this approach,. List your debts from smallest to largest regardless of interest rate. Dave ramsey debt snowball form. These worksheets ensure that it’s easy to clear off your debt promptly and visibly see the progress you’re making. Save for your children’s college fund. This method focuses on paying down your smallest debt balance before moving onto larger ones. Pay as much as possible on your smallest debt. Get your debt snowball rolling. Get expert advice delivered straight to your inbox. You may have noticed that the smallest debt is paid first, not the highest interest rate. Web dave ramsey debt snowball calculator! There are two popular methods folks use to become debt free: Web dave ramsey debt snowball calculator! You then make minimum payments on all your debts except for the smallest debt. And while dave ramseypopularized the debt snowball method, he didn’t actually create it. The basic idea of the snowball debt spreadsheet is to pay off your smallest debt as. Before we dive into the details of the debt snowball spreadsheet, let’s talk about what the debt snowball is, and why it’s a great way to tackle your existing debts. Here are the basic steps if the debt snowball method. Invest 15% of your household income in retirement. Web dave ramsey debt snowball. Use the famous dave ramsey method to. Web this technique, made popular by financial guru dave ramsey, is an especially great technique to try if you are having trouble getting motivated to pay off your debt. Document your debts and include their balances. You may have noticed that the smallest debt is paid first, not the highest interest rate. Web here’s how the debt snowball works: Pay. Web dave ramsey debt snowball. Web dave ramsey is famous for spreading the concept of the debt snowball spreadsheet or debt reduction spreadsheet. Web here’s how the debt snowball works: Get rid of your debt fast! Invest 15% of your household income in retirement. Web here’s how the debt snowball works: Once the smallest debt is paid off, one proceeds to the next larger debt, and so forth, proceeding to the largest ones last. Here are the basic steps if the debt snowball method. Save for your children’s college fund. Web dave ramsey debt snowball calculator! This is the exact debt snowball form that we used to get out debt in that short period of time. When using this technique to pay off your debt quickly, the trick. Make minimum payments on all your debts except the smallest. Web this is the fun one! Attack that one with everything you’ve got, using any extra money you. Once the smallest debt is paid off, one proceeds to the next larger debt, and so forth, proceeding to the largest ones last. Web here’s how the debt snowball works: And while dave ramseypopularized the debt snowball method, he didn’t actually create it. Document your debts and include their balances. The basic idea of the snowball debt spreadsheet is to. List all of your debts smallest to largest, and use this sheet to mark them off one by one. Web learn why dave ramsey’s debt snowball method is the best way to knock out all of your debt. Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with. You begin by listing your debts from smallest to largest in terms of the balance. Some of the worksheets displayed are debt snowball quick start budget, debt snowball instructions, debt total amount owed snowball work month debt name, dave ramseys guide budgeting, the debt snowball, how to make a budget using the. This method focuses on paying down your smallest. When using this technique to pay off your debt quickly, the trick. Invest 15% of your household income in retirement. Get your debt snowball rolling. Web the debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months. Web the snowball method is a common debt repayment strategy. Pay as much as possible on your smallest debt. Web let’s discuss the different templates to use. Use the famous dave ramsey method to payoff your debt, using this automatic tracker template! Web learn why dave ramsey’s debt snowball method is the best way to knock out all of your debt. List your debts from smallest to largest regardless of interest rate. Web dave ramsey debt snowball calculator! Attack that one with everything you’ve got, using any extra money you have left after you’ve covered necessities. Here are the basic steps if the debt snowball method. With that one, you throw everything extra at it until it’s paid off. The strength of using this method is that it focuses on the behavioral side of. Once the smallest debt is paid off, one proceeds to the next larger debt, and so forth, proceeding to the largest ones last. That’s where we first heard about it, and when we first started working to become debt free, we knew the basic principle is to pay off your smallest debt as fast as possible. Jan feb mar 100% 10% With the debt snowball method, you pay off your debt from the smallest balance to the lowest balance. List all of your debts smallest to largest, and use this sheet to mark them off one by one.Dave Ramsey Debt Snowball Calculator Excel Budget Planner Etsy

It's easy to pay off debt quickly with Dave Ramsey's debt snowball

Dave Ramsey Debt Snowball Spreadsheet Calculator Credit Card Etsy Ireland

Dave Ramsey Debt Snowball Worksheets —

Dave Ramsey Inspired Debt Snowball Spreadsheet Excel Etsy

Using Dave Ramsey's debt snowball method to pay off debt? This free

Dave Ramsey Debt Snowball Spreadsheet Calculator Credit Card Etsy Ireland

Dave Ramsey Debt Snowball Spreadsheet Calculator Credit Card Etsy Ireland

Debt Snowball Printable Sheet Dave Ramsey Inspired Debt Etsy

Dave Ramsey Debt Snowball Worksheets —

Related Post: