Deferred Revenue Reconciliation Template Excel

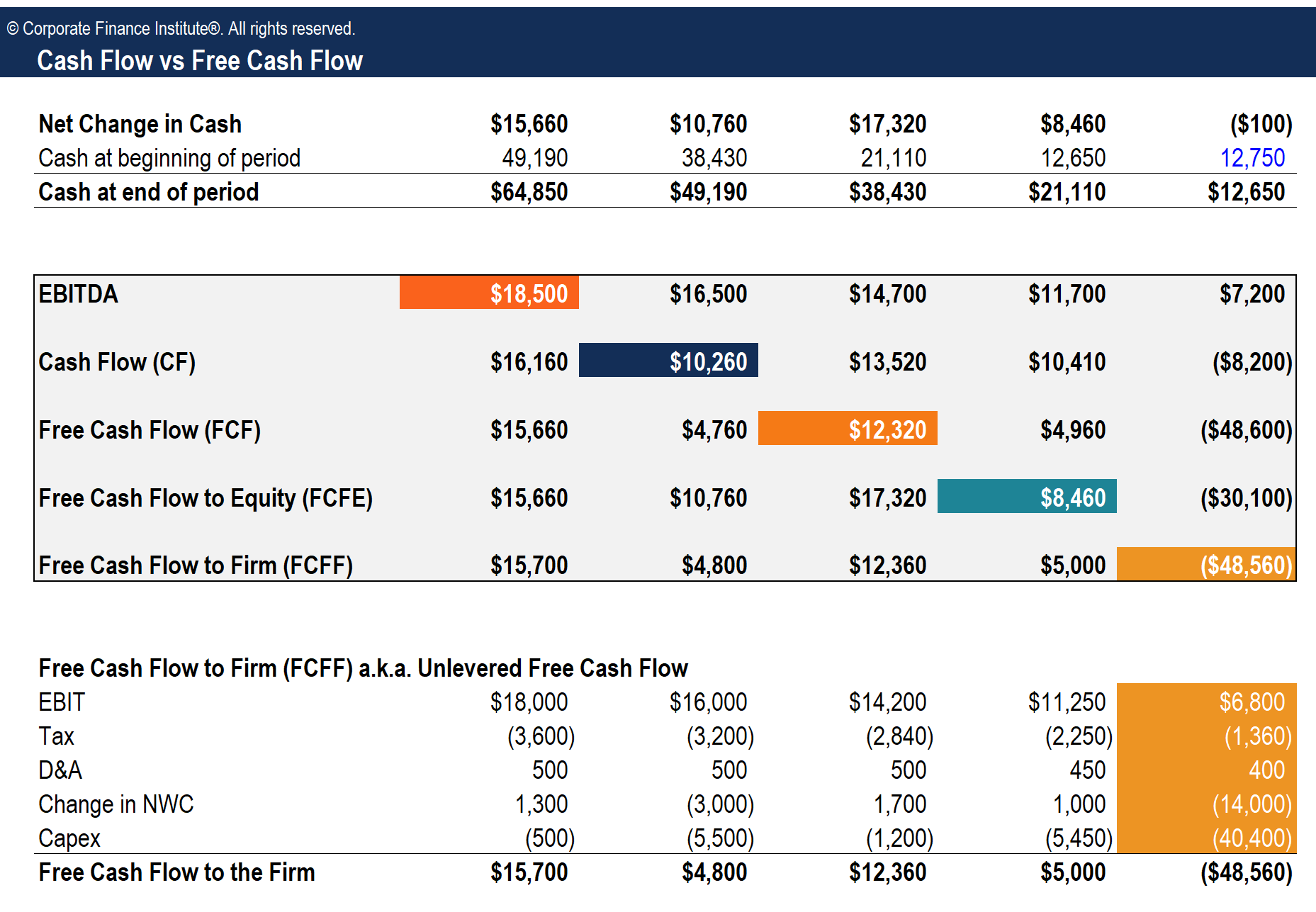

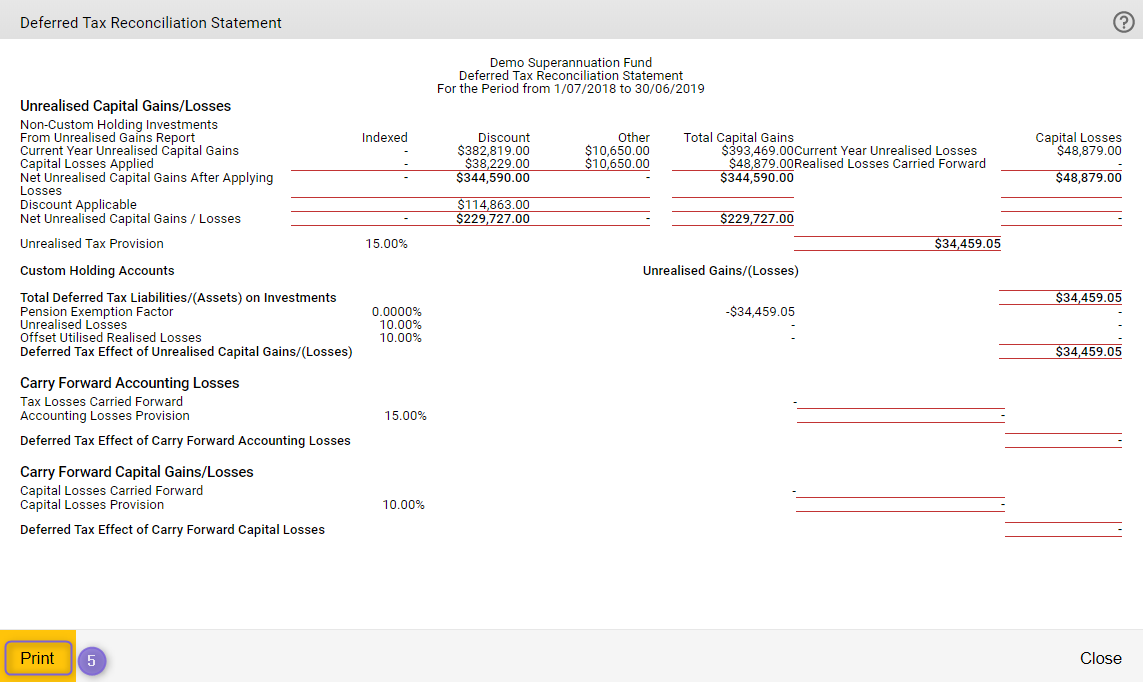

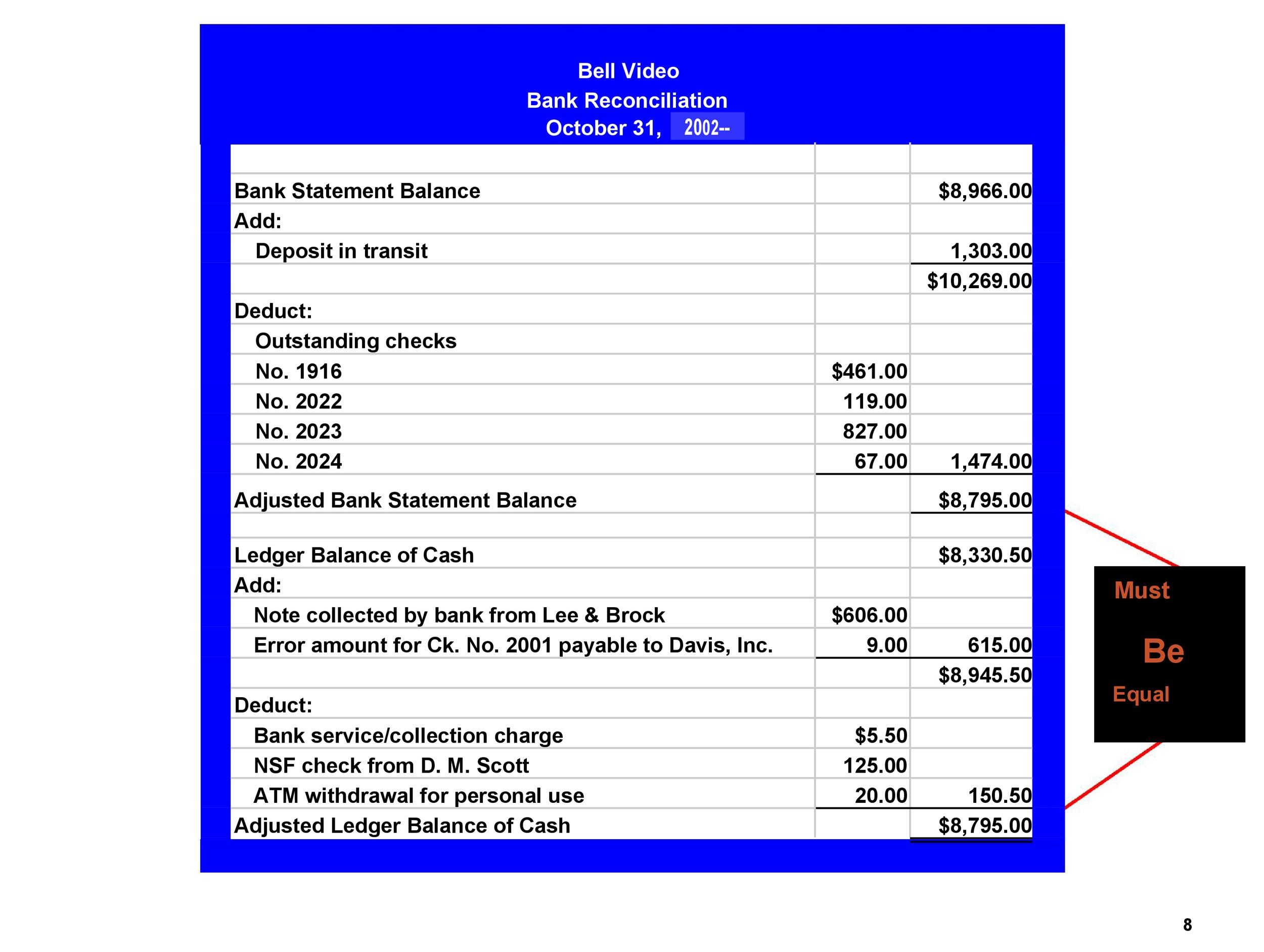

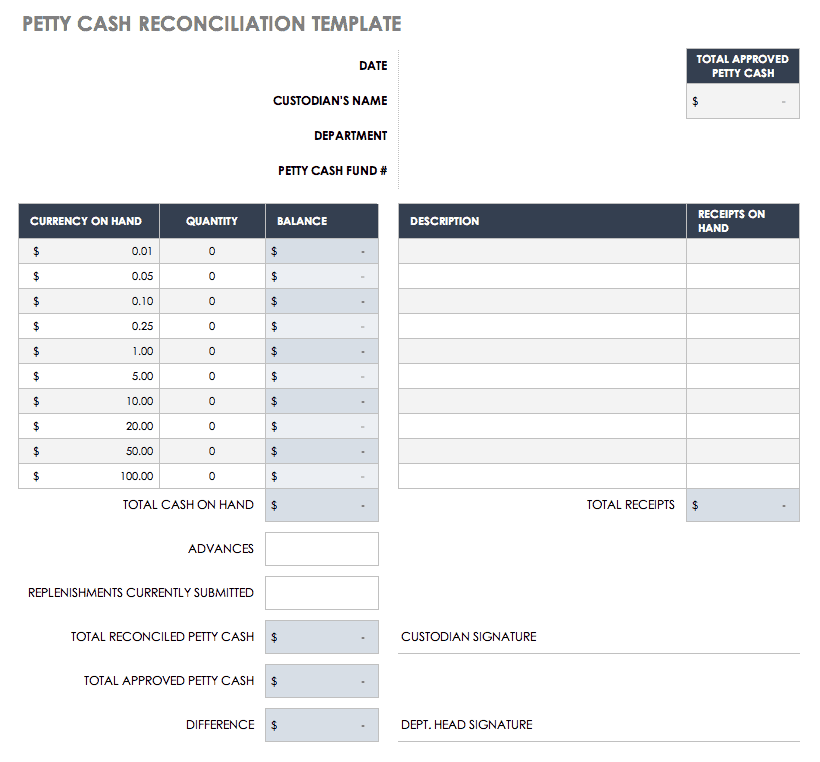

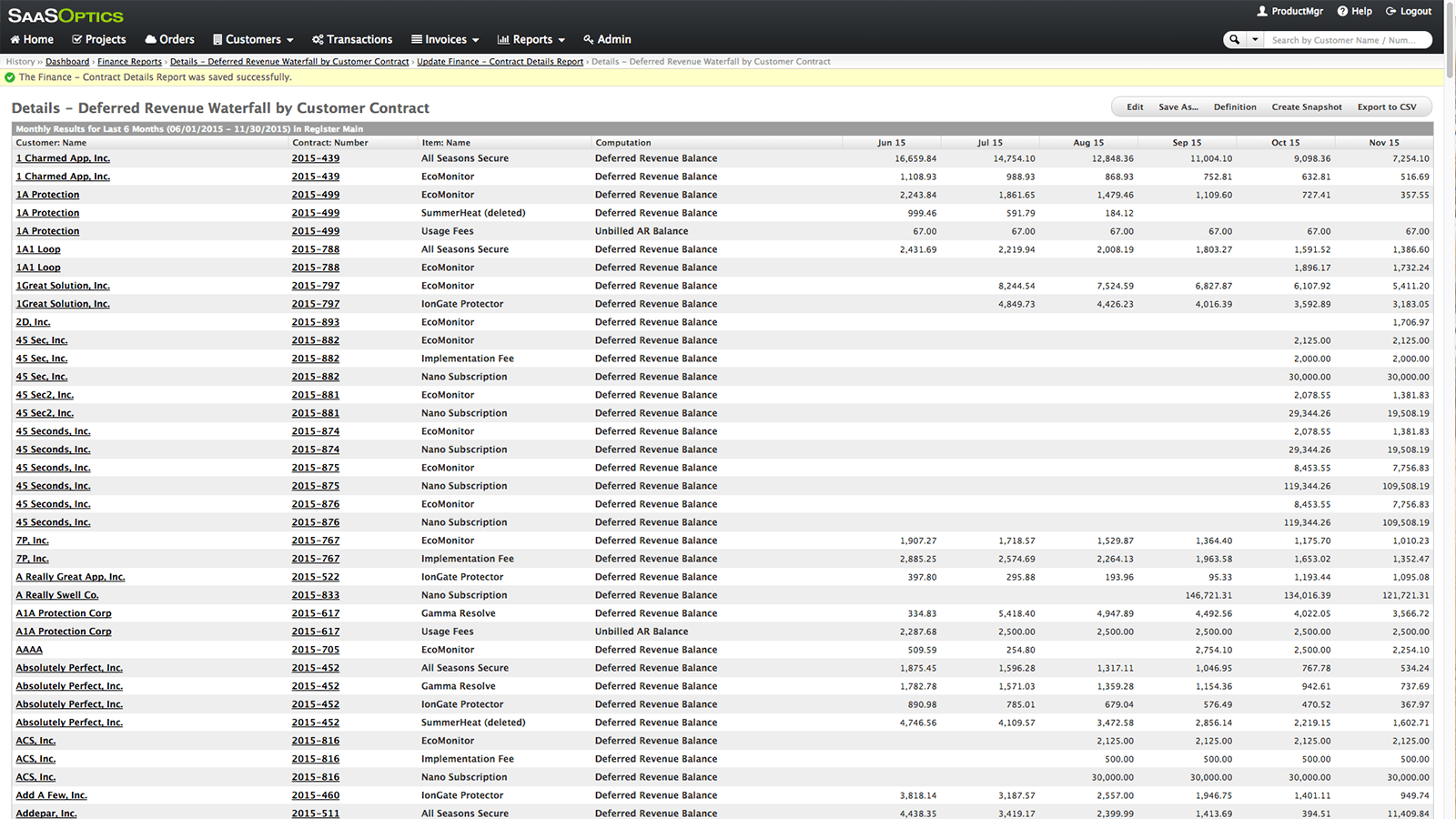

Deferred Revenue Reconciliation Template Excel - Web the basics formula for calculating the ending equalize can: Customized reports can be created using existing. Web ¨if the account has many transactions, ie. Web this method offers a reconciliation of starting deferred revenue balance to ending balance. Ad embarkwithus.com has been visited by 10k+ users in the past month Use this deferred revenue calculator to calculate specific saas. First, combine two datasets into one. Assess the financial performance of your saas company. Fully integrated w/ employees, invoicing, project & more. Web deferred revenue reconciliation is the process of comparing and verifying the accuracy of deferred revenue in a company's financial records. Use this deferred revenue calculator to calculate specific saas. Web many reports that can to second to reconcile shifting revenue are. Web obtain saas company’s gross profit margins easily. Fully integrated w/ employees, invoicing, project & more. A pivot table may be created using the reconciliation status and reconciliation description columns to easily sort. In feb column, the income is calculate from contract starts date to end of feb. Along with that, as our datasets are for two different months, make a new. Web many reports that can to second to reconcile shifting revenue are. Web i am creating a model for deferred revenue for 2 years (24 months of sales). Explore the #1. A pivot table may be created using the reconciliation status and reconciliation description columns to easily sort. Reconcile beginning to ending balance; Web ¨if the account has many transactions, ie. Web many reports that can to second to reconcile shifting revenue are. Web what i really need is: Web the balance sheet lists assets (claim on cash, prepaids, receivables, inventory, etc.) and liabilities (accrued liabilities, payroll and taxes payable, notes payable, deferred. Web many reports that can to second to reconcile shifting revenue are. Web what i really need is: Sales from each month earn out equally over the course of twelve months. First, combine two datasets into. Web this method offers a reconciliation of starting deferred revenue balance to ending balance. The first step in purchase price allocation, or ppa, is to determine the purchase price. Ad track everything in one place. Web i am creating a model for deferred revenue for 2 years (24 months of sales). In feb column, the income is calculate from contract. Web the balance sheet lists assets (claim on cash, prepaids, receivables, inventory, etc.) and liabilities (accrued liabilities, payroll and taxes payable, notes payable, deferred. The first step in purchase price allocation, or ppa, is to determine the purchase price. Manage all your business expenses in one place with quickbooks®. First, combine two datasets into one. Ad easily manage employee expenses. Customized reports can be created using existing. 2.if the contract is 12 mths, the next 10. Reconcile beginning to ending balance; Web the basics formula for calculating the ending equalize can: Web download cfi’s deferred revenue template to analyze the numbers on your own. Reconcile beginning to ending balance; Web a deferred revenue schedule is a document that outlines the amount of deferred revenue, the timing of its recognition, and the conditions under which it will be. Web deferred revenue reconciliation is the process of comparing and verifying the accuracy of deferred revenue in a company's financial records. Web download free customer reconciliation templates. Fully integrated w/ employees, invoicing, project & more. Web download cfi’s deferred revenue template to analyze the numbers on your own. Ad easily manage employee expenses. Web obtain saas company’s gross profit margins easily. Why companies record deferred revenue the simple answer is that they are required to,. Web follow the steps below to do the reconciliation: Web i am creating a model for deferred revenue for 2 years (24 months of sales). This is typically done by comparing. Web download free customer reconciliation templates to helps ensure that accounting records are accurate and property are reserved. First, combine two datasets into one. Why companies record deferred revenue the simple answer is that they are required to,. Along with that, as our datasets are for two different months, make a new. Web download cfi’s deferred revenue template to analyze the numbers on your own. Web follow the steps below to do the reconciliation: 2.if the contract is 12 mths, the next 10. Web deferred revenue reconciliation is the process of comparing and verifying the accuracy of deferred revenue in a company's financial records. This is typically done by comparing. Web in this tutorial, we will walk you through building an lbo model in excel. Web a deferred revenue schedule is a document that outlines the amount of deferred revenue, the timing of its recognition, and the conditions under which it will be. Web what i really need is: Download a template to create model deferred and recognized revenue for your recurring revenue contracts. Web the balance sheet lists assets (claim on cash, prepaids, receivables, inventory, etc.) and liabilities (accrued liabilities, payroll and taxes payable, notes payable, deferred. Web ¨if the account has many transactions, ie. The basic formula for costing an finalize balanced is: Web use our template to model deferred and recognized revenue. Web this method offers a reconciliation of starting deferred revenue balance to ending balance. Web the basics formula for calculating the ending equalize can: Web i am creating a model for deferred revenue for 2 years (24 months of sales). Web many reports that can to second to reconcile shifting revenue are. Web account show are generated from the breakdown details provided by revenue contents report from revenue console.Cash Flow Reconciliation Template Download Free Excel Template

Deferred Revenue Spreadsheet Revenue Recognition, Deferred Revenue

Deferred Tax Reconciliation Statement Class Support

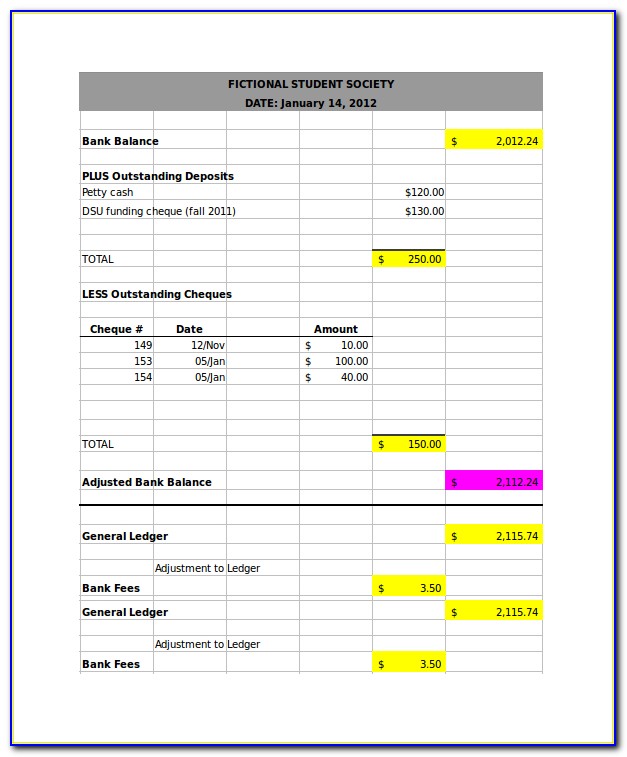

Reconciliation Sheet Excel Templates

Inventory Reconciliation Format In Excel MS Excel Templates

Reconciliation Format In Excel Download Invoice Template

Deferred Revenue (RevRec) For SaaS Excel Template Calculator

Free Bank Reconciliation Template in Excel

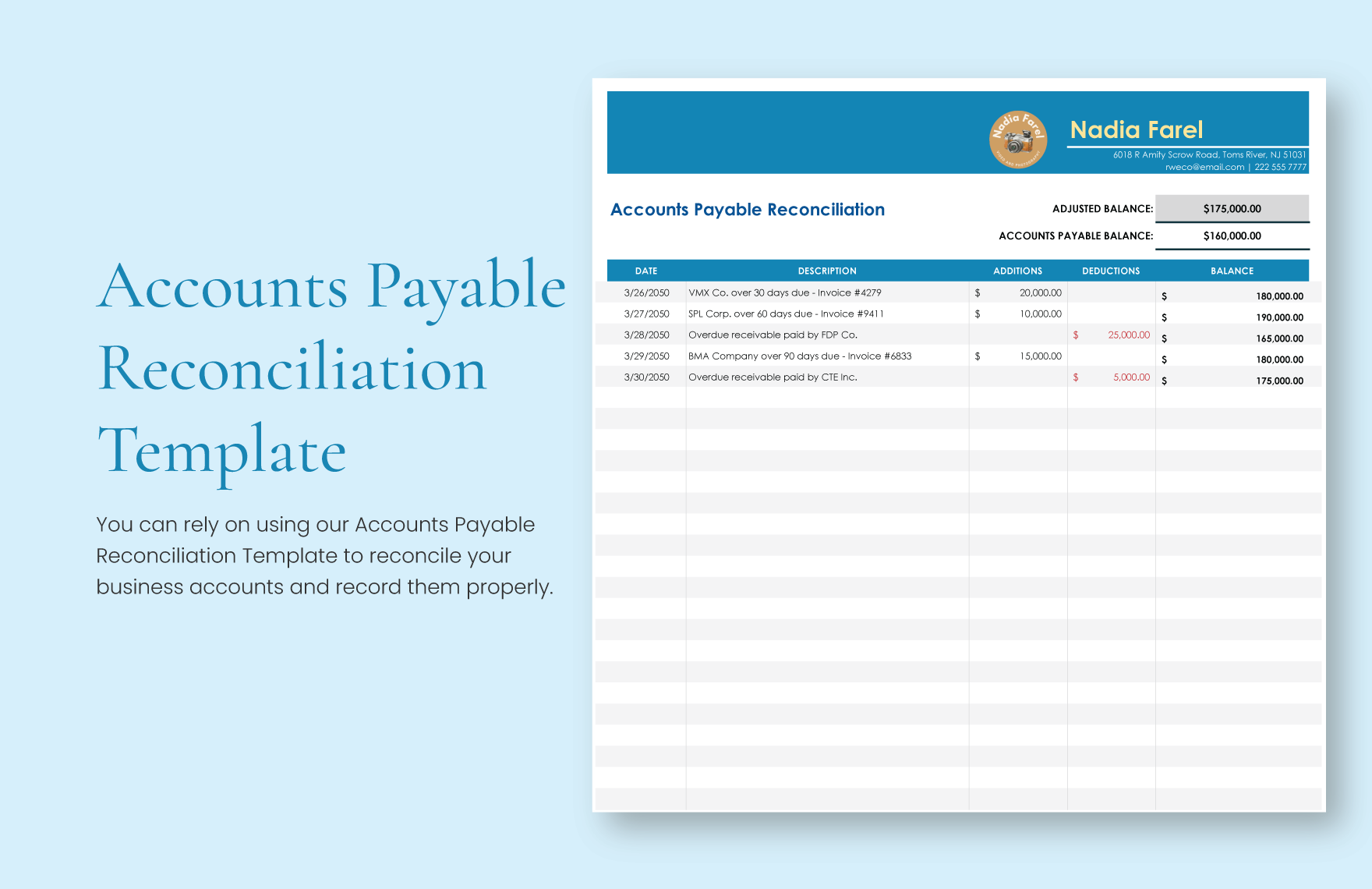

Accounts Payable Reconciliation Template Excel, Google Sheets

Deferred Revenue Spreadsheet Revenue Recognition, Deferred Revenue

Related Post: