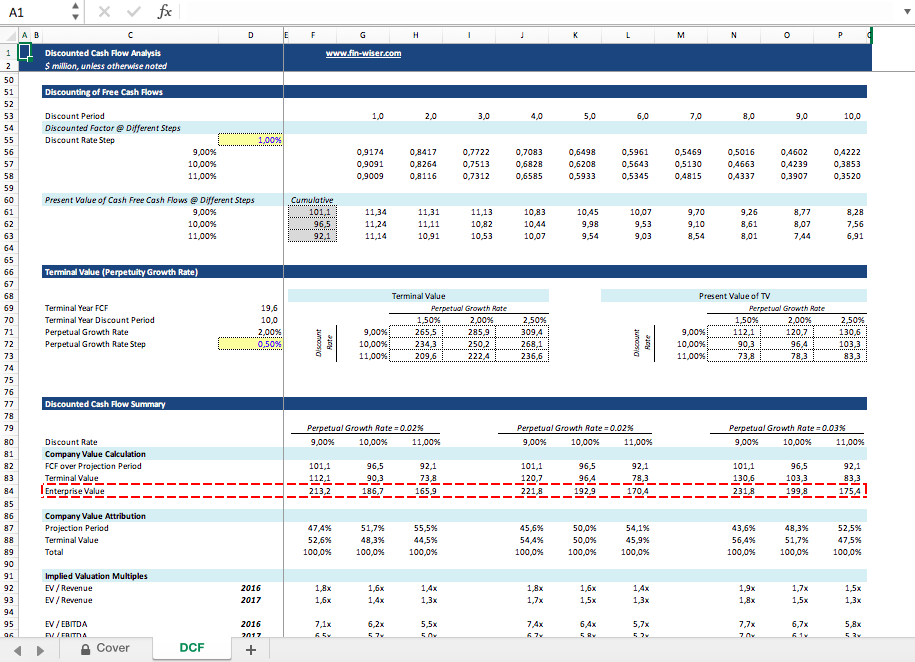

Discounted Cash Flow Template Excel

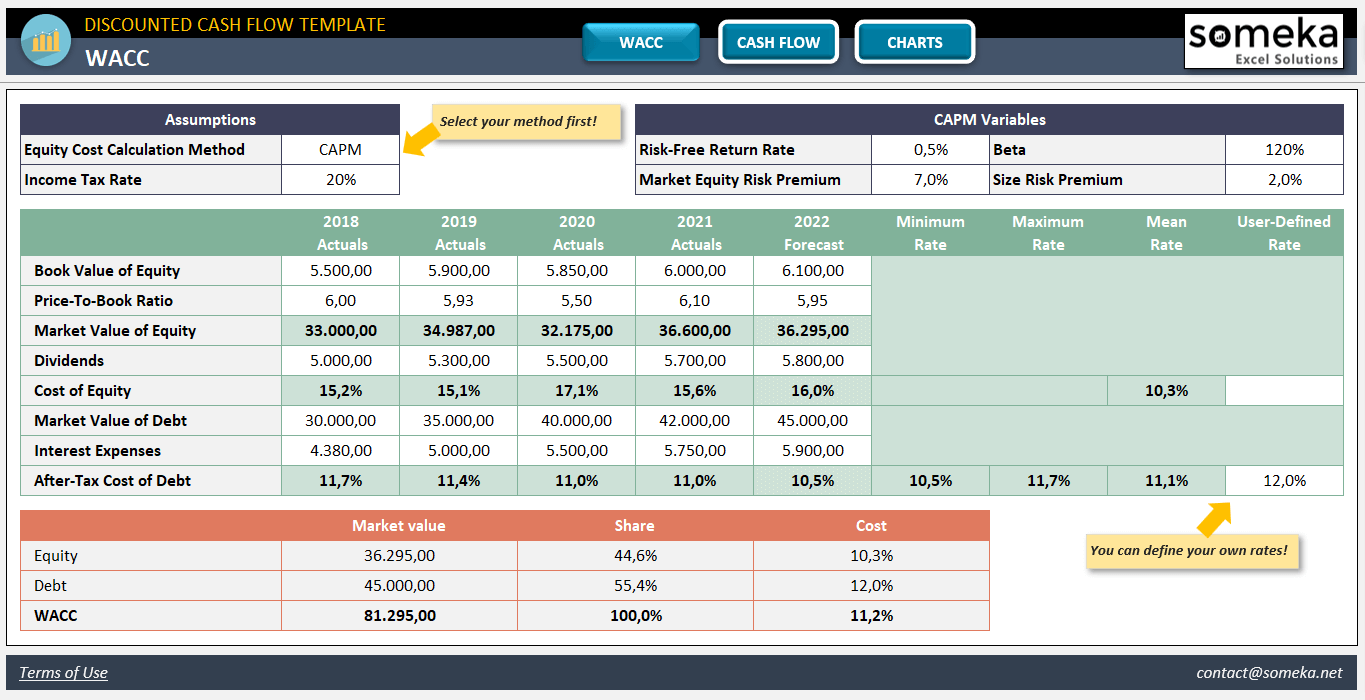

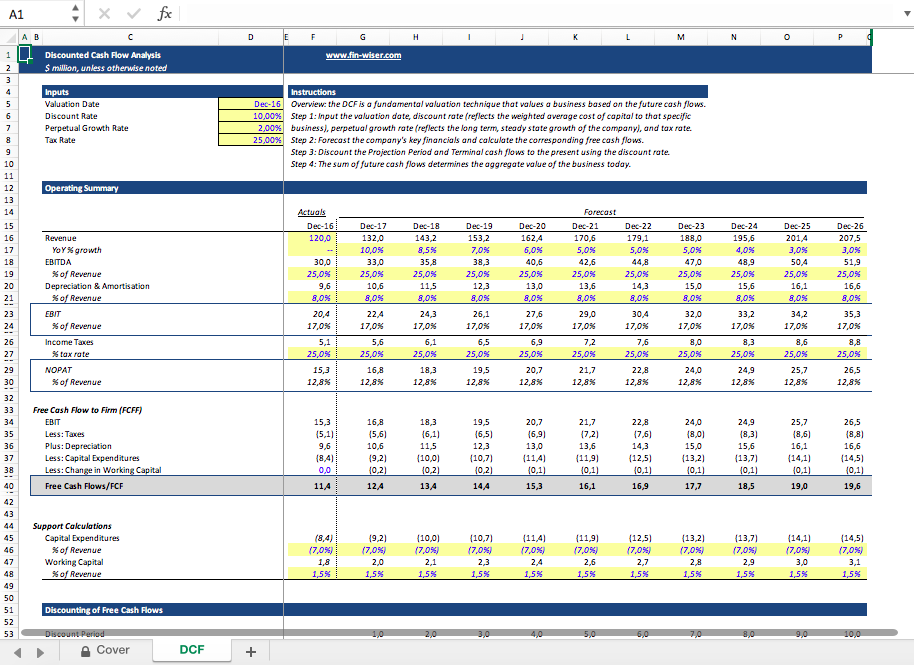

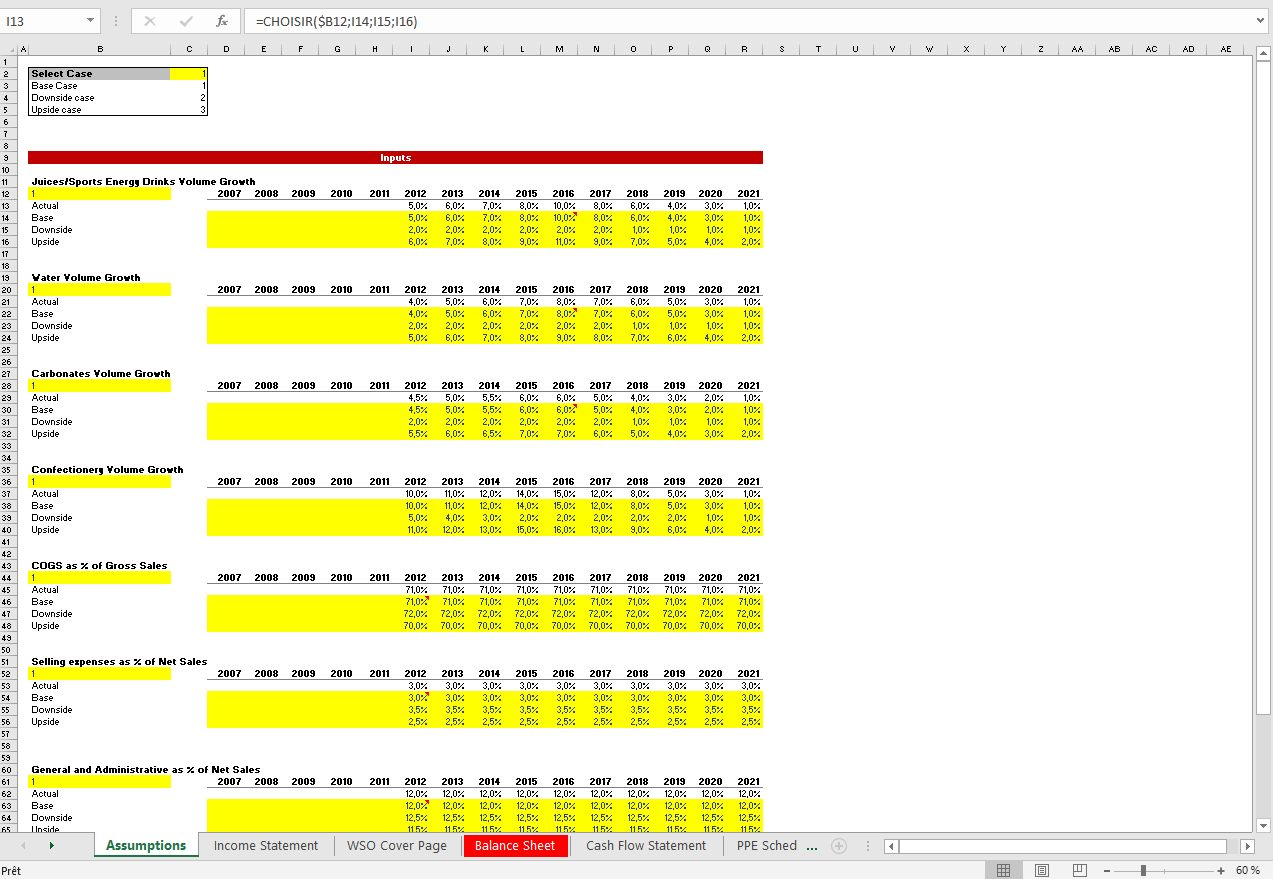

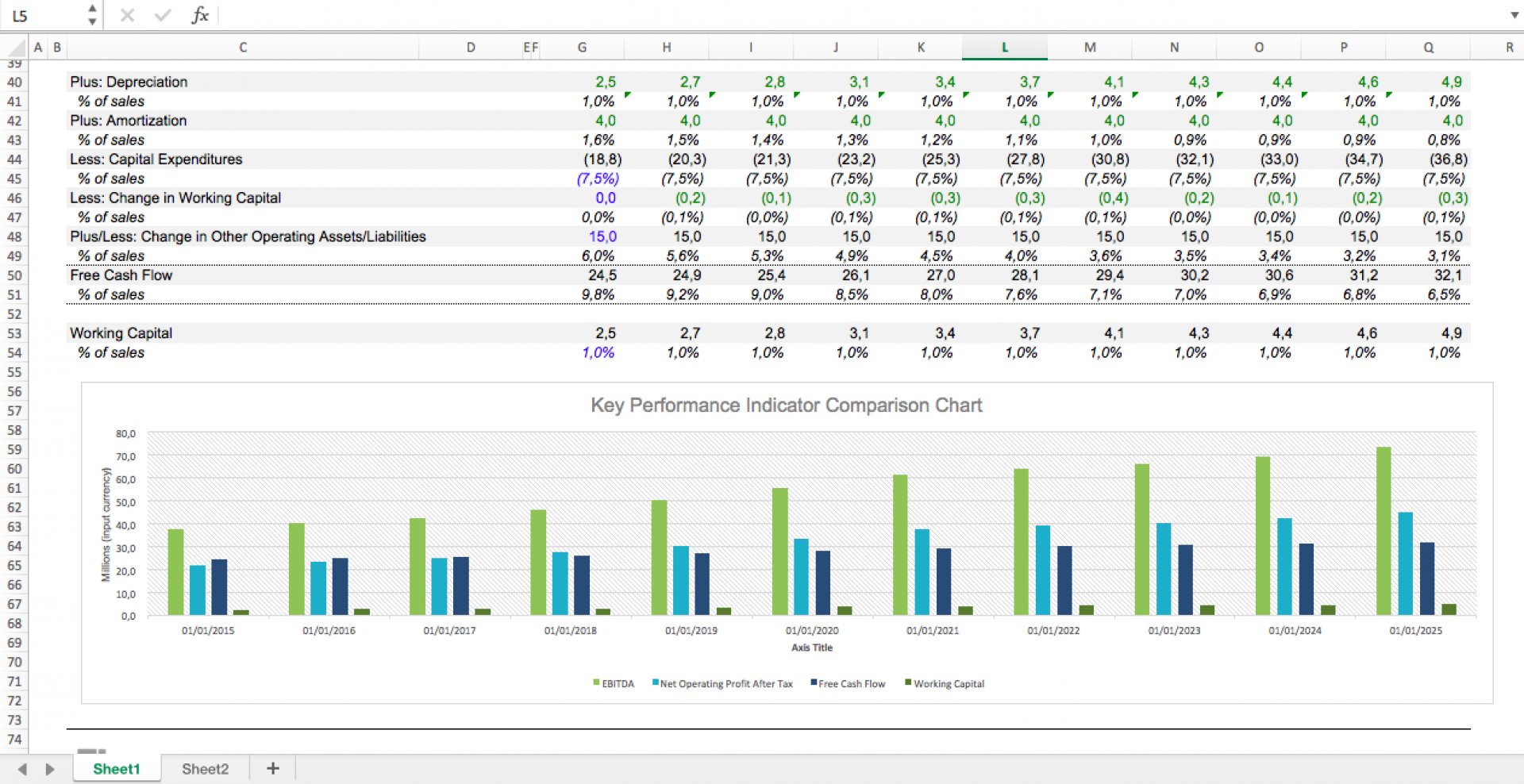

Discounted Cash Flow Template Excel - Download wso's free discounted cash flow (dcf) model template below! However, if cash flows are different each year, you will have to discount each cash flow separately: Discover the intrinsic value of any company using our free discounted cash flow (dcf) template. Dcf = cf1 / (1 + r)1 + cf2 / (1 + r)2 + cf3 / (1 + r)3+ cfn / (1 + r)n. Where, cf = cash flow in year. Web up to 50% cash back if you're looking for discounted cash flow excel templates, look no further! Web ms excel has two formulas that can be used to calculate discounted cash flow, which it terms as “npv.” regular npv formula: * dashboard, * income statement, * cash flow, * balance sheet, * wacc calculation, *. Web discounted cash flow valuation model: Using discounted cash flow formula in excel to calculate free cashflow to firm (fcff) in this example, we will calculate the free cashflow to firm (. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. This template allows you to build your own discounted cash flow model with. * dashboard, * income statement, * cash flow, * balance sheet, * wacc calculation, *. Web discounted cash flow model template; Designed with both novice investors and. Web what is the function dcf in excel? Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Web the formula for dcf is: * dashboard, * income statement, * cash flow, * balance sheet, * wacc calculation, *. Web discounted cash flow. Cf = the cash flow in a given year (cf1 is year one. Here’s a template for a discounted cash flow (dcf) analysis excel sheet: However, if cash flows are different each year, you will have to discount each cash flow separately: Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future. This template allows you to build your own discounted cash flow model with. Web up to 50% cash back if you're looking for discounted cash flow excel templates, look no further! Where, cf = cash flow in year. We've gathered 10 of the best templates available online, and. Web discounted cash flow (dcf) excel model template. However, if cash flows are different each year, you will have to discount each cash flow separately: The purpose of the discounted free cash flow financial model template is to provide the user with a. Web this file allows you to calculate discounted cash flow in excel. Using discounted cash flow formula in excel to calculate free cashflow to firm. Discounted cash flow excel sheet. This template allows you to build your own discounted cash flow model with. Web what is the function dcf in excel? Here’s a template for a discounted cash flow (dcf) analysis excel sheet: Web up to 50% cash back if you're looking for discounted cash flow excel templates, look no further! Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. This template allows you to build your own discounted cash flow model with. Web in excel, you can calculate this using the pv function (see below). Dcf = cf1 / 1 + r1. Web the formula for dcf is: This template allows you to build your own discounted cash flow model with. However, if cash flows are different each year, you will have to discount each cash flow separately: Web discounted cash flow model template; It includes an example to help you apply. Web up to 50% cash back if you're looking for discounted cash flow excel templates, look no further! Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Web what is the function dcf in excel? It looks at the present value of. Designed with both novice investors and. Web this file allows you to calculate discounted cash flow in excel. (vynt) dcf excel template main parts of the financial model: Web discounted cash flow valuation model: Here’s a template for a discounted cash flow (dcf) analysis excel sheet: The purpose of the discounted free cash flow financial model template is to provide the user with a. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. Web discounted cash flow model template; Dcf = cf1 / (1 + r)1 + cf2 / (1 + r)2 + cf3 / (1 + r)3+ cfn / (1 + r)n. However, if cash flows are different each year, you will have to discount each cash flow separately: Discounted cash flow valuation template ; We've gathered 10 of the best templates available online, and. Discover the intrinsic value of any company using our free discounted cash flow (dcf) template. Where, cf = cash flow in year. Web in excel, you can calculate this using the pv function (see below). Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Book a playbook demo to explore — schedule a call with us and. Web basic discounted cash flow formula: Discounted cash flow analysis template; Web up to 50% cash back if you're looking for discounted cash flow excel templates, look no further! Web this file allows you to calculate discounted cash flow in excel. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. It looks at the present value of annual cash flows, allowing you to adjust the template for the discount rate. Web discounted cash flow valuation model: (vynt) dcf excel template main parts of the financial model:Discounted Cash Flow Excel Template DCF Valuation Template

discounted cash flow excel template —

DCF Discounted Cash Flow Model Excel Template Eloquens

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

7 Cash Flow Analysis Template Excel Excel Templates

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Discounted Cash Flow (DCF) Excel Model Template Eloquens

DCF Discounted Cash Flow Model Excel Template Eloquens

Discounted Cash Flow (DCF) Model Macabacus

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Related Post: