Discounted Cash Flow Template

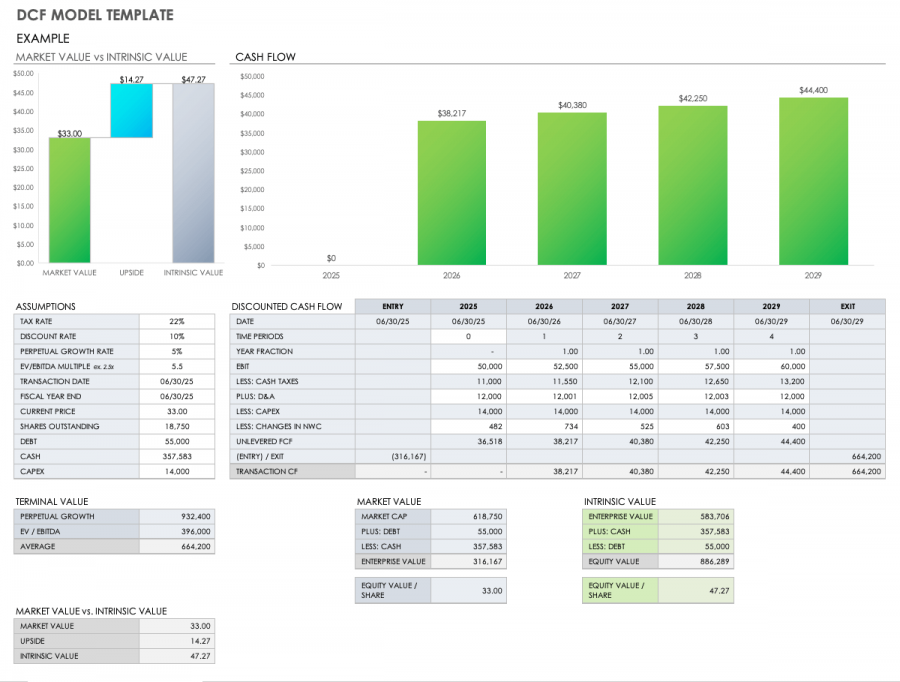

Discounted Cash Flow Template - This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. In the template below you can see the same projected cash flow for each. Web while unrealistic, it makes it easier to see the effect that time has on the value of projected cash flows. Web discounted cash flow template. Tips for doing a discounted cash flow analysis; Designed with both novice investors and seasoned financial analysts in mind,. Web discover the intrinsic value of any company using our free discounted cash flow (dcf) template. The company’s cash flow, cash flow growth rate, and potentially even the discount rate change over 5, 10, 15, or 20+ years, but the. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn where, cf = cash flow in year r=. Web discounted cash flow (dcf) is an analysis method used to value investment by discounting the estimated future cash flows. The formula for dcf is: In the template below you can see the same projected cash flow for each. Designed with both novice investors and seasoned financial analysts in mind,. Web discounted cash flow template. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn where, cf = cash flow in. Web dcf stands for d iscounted c ash f low, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is called. Web period #1 (explicit forecast period): This dcf model template helps you: Ad embarkwithus.com has been visited by 10k+ users in the past month Enter your name. Enter the net income, change in working capital (ap &. Web discounted cash flow template. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn where, cf = cash flow in year r=. Web a discounted cash flow model is one of the primary valuation methods used by finance professionals to. Web discounted cash flow template. This dcf model template helps you: Web on this page, you’ll find the following: This template allows you to build your own discounted cash flow model with. Enter the assumptions on discount rate and terminal growth rate. The model is completely flexible, so that when you put in the. The company’s cash flow, cash flow growth rate, and potentially even the discount rate change over 5, 10, 15, or 20+ years, but the. Web a discounted cash flow model is one of the primary valuation methods used by finance professionals to derive a company's fair value. Web. This dcf model template helps you: Dcf analysis can be applied to value a. The formula for dcf is: Web while unrealistic, it makes it easier to see the effect that time has on the value of projected cash flows. Web discover the intrinsic value of any company using our free discounted cash flow (dcf) template. Therefore the price investors should pay. Web discover the intrinsic value of any company using our free discounted cash flow (dcf) template. Web what is the discounted cash flow dcf formula? In the template below you can see the same projected cash flow for each. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Web template for discounted cash flow dcf used to estimate the value of an investment based on its future cash flows. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash. This template allows you to build your own discounted cash flow model with. Web discounted cash flow valuation model: Ad embarkwithus.com has been visited by 10k+ users in the past month Enter the net income, change in working capital (ap &. The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all. Web a discounted cash flow model is one of the primary valuation methods used by finance professionals to derive a company's fair value. Web discounted cash flow valuation model: Dcf analysis finds the present value of expected future. Web period #1 (explicit forecast period): Web template for discounted cash flow dcf used to estimate the value of an investment based. Web what is the discounted cash flow dcf formula? Web discounted cash flow (dcf) is an analysis method used to value investment by discounting the estimated future cash flows. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Below is a preview of the dcf model template: Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows. Enter the assumptions on discount rate and terminal growth rate. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. Web while unrealistic, it makes it easier to see the effect that time has on the value of projected cash flows. Download wso's free discounted cash flow (dcf) model template below! Enter the net income, change in working capital (ap &. Enter your name and email in the form below and download the free template now! How do you calculate discounted cash flows? Web template for discounted cash flow dcf used to estimate the value of an investment based on its future cash flows. Dcf analysis finds the present value of expected future. Web dcf stands for d iscounted c ash f low, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is called. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Web on this page, you’ll find the following: Dcf analysis can be applied to value a. Designed with both novice investors and seasoned financial analysts in mind,. The company’s cash flow, cash flow growth rate, and potentially even the discount rate change over 5, 10, 15, or 20+ years, but the.Discounted Cash Flow Template Free DCF Valuation Model in Excel!

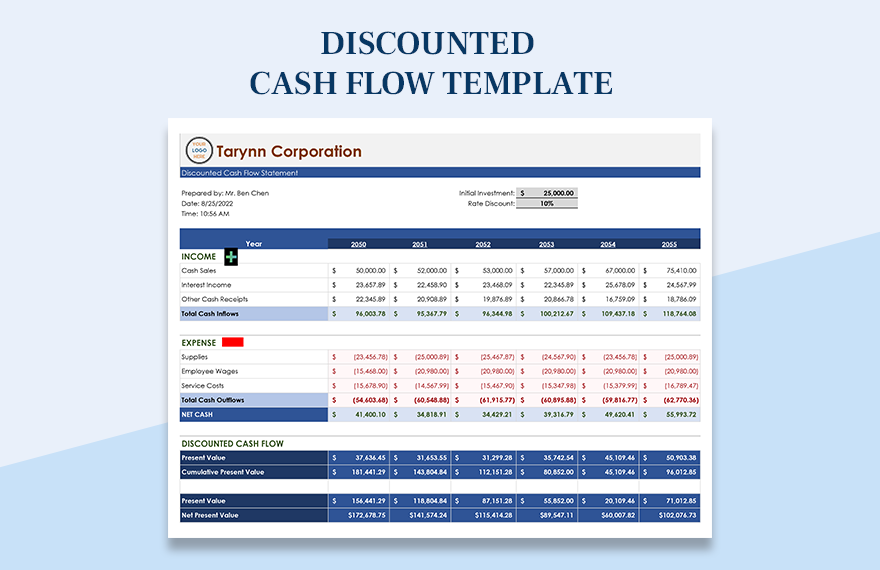

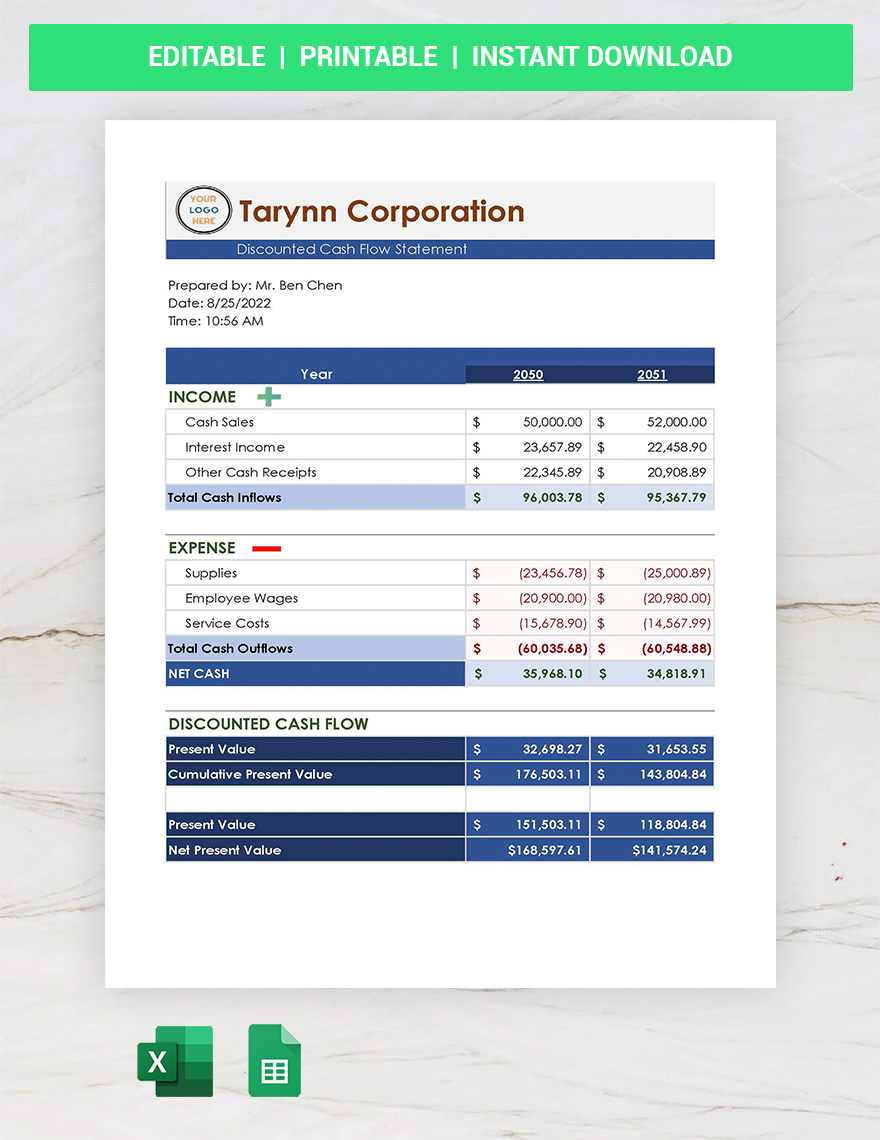

Discounted Cash Flow Template Google Docs, Google Sheets, Excel, Word

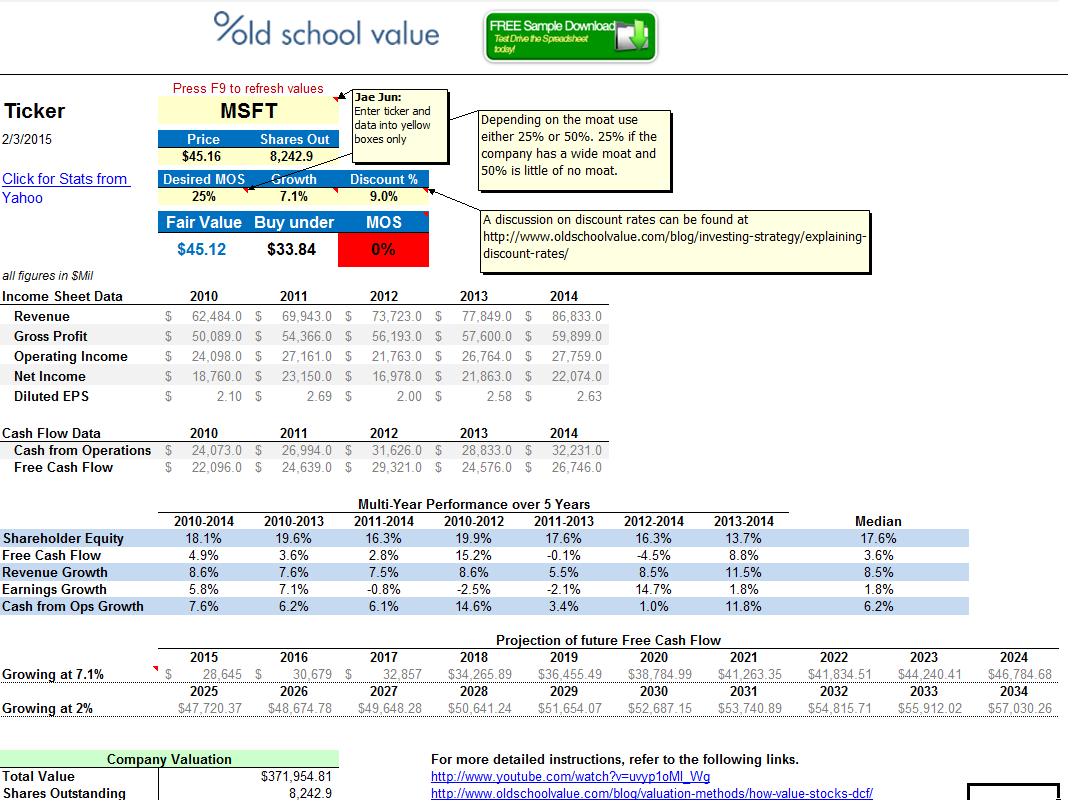

Discounted Cash Flow Spreadsheet

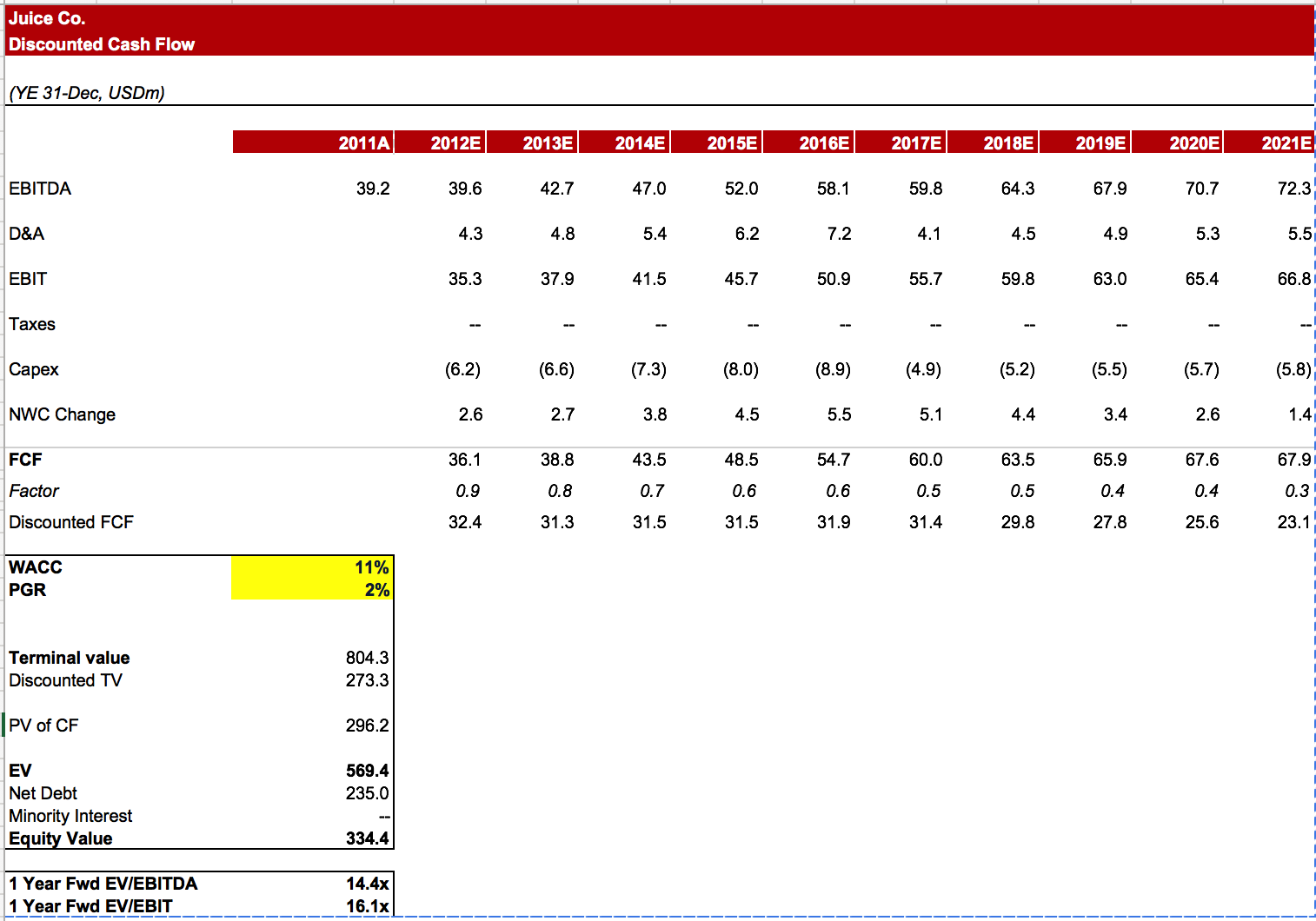

Discounted Cash Flow (DCF) Model Macabacus

Discounted Cash Flow Template Google Docs, Google Sheets, Excel, Word

Discounted Cash Flow (DCF) Model Template Wall Street Oasis

Free Discounted Cash Flow Templates Smartsheet

Cash Flow Analysis Template 11+ Download Free Documents in PDF, Word

Discounted Cash Flow (DCF) Model Macabacus

Free Discounted Cash Flow Templates Smartsheet

Related Post: