Promissory Note Template With Amortization Schedule

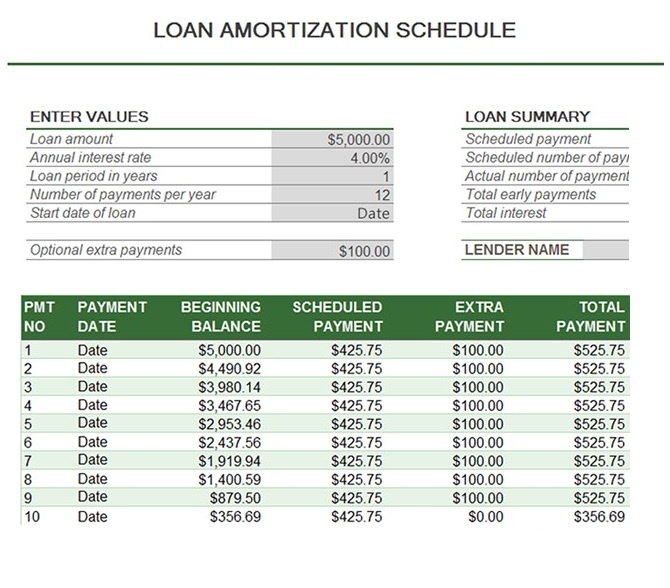

Promissory Note Template With Amortization Schedule - Web an amortization schedule helps the borrower know exactly what amount of each payment goes to paying interest and what goes to paying the principal sum. Give your lender confidence by outlining the terms of your loan and repayment plan. You fill in the principal amount, interest rate, payment frequency, and total number of payments. Discover the answers you need here! In every way, this promotes a successful and profitable business arrangement. Set up the amortization table for starters, define the input cells where you will enter the known components of a loan: Download & print in minutes. Promissory note templates (2) create a high quality document now! Start your own note payable form online now.a promissory note is an important document that's considered legally binding, considering, of course, it. Web promissory note template alabama with amortization schedule. Web promissory note template alabama with amortization schedule. Commencing on the 1st day of april, 2024 and on the first of each month thereafter, principal and interest shall be payable in installments of $100,000 per month. Create a promissory note instantly. In every way, this promotes a successful and profitable business arrangement. Web with an amortization schedule template for microsoft. Set up the amortization table for starters, define the input cells where you will enter the known components of a loan: A written note can minimize confusion, misunderstanding, and error, and clearly set forth the parties’ expectations and fulfillment obligations. It is a legal document for a loan and becomes legally binding when. Web simple promissory note sample with amortization. Ad get a fillable promissory note. Web simple promissory note sample with amortization schedule category: Web create a printable amortization schedule with dates and subtotals to see how much principal and interest you'll pay over time. Web promissory note template alabama with amortization schedule. Promissory note templates (2) create a high quality document now! Web payment schedule and amounts: Web make a secured promissory note (fully amortized) in minutes. A promissory note is a written promise made by a borrower to a lender to repay a specified sum of money. Rich text instant download buy. Web the lender can use an amortization schedule to showcase the borrower's promise to pay back the loan either. Web the free promissory note below is downloadable in microsoft word format it is designed for an unsecured loan, and it require that you calculate the amortization & repayment schedule (interest and payment schedule). Simple loan calculator and amortization table for most any type of loan, microsoft offers a handy amortization table template for excel. You fill in the principal. You fill in the principal amount, interest rate, payment frequency, and total number of payments. Ad get a fillable promissory note. Give your lender confidence by outlining the terms of your loan and repayment plan. Web promissory note template alabama with amortization schedule. An unsecured promissory note (fully amortized) is a promise to pay back a loan when there's no. Rich text instant download buy. Web with an amortization schedule template for microsoft excel, you can enter the basic loan details and view the entire schedule in just minutes. Give your lender confidence by outlining the terms of your loan and repayment plan. Ad search for answers from across the web with searchresultsquickly.com. A written note can minimize confusion, misunderstanding,. The calculator will then produce a payment schedule. Web promissory note templates. Set up the amortization table for starters, define the input cells where you will enter the known components of a loan: Download & print in minutes. Start by entering the total loan amount, the annual interest rate, the number of years required to repay the loan, and how. This amortization schedule calculator will calculate an uknown payment amount, loan amount, rate, or term. Start by entering the total loan amount, the annual interest rate, the number of years required to repay the loan, and how frequently the payments must be made. There’s no longer a need to waste money on attorneys to compose your legal paperwork. A promissory. Discover the answers you need here! A template simplifies what can often be a complex process with many difficult formulas. Web with an amortization schedule template for microsoft excel, you can enter the basic loan details and view the entire schedule in just minutes. Web the free promissory note below is downloadable in microsoft word format it is designed for. Download & print in minutes. This amortization schedule calculator will calculate an uknown payment amount, loan amount, rate, or term. Download these 10 free promissory note templates in ms word format to study and prepare your own promissory note comprehensively. Start your own note payable form online now.a promissory note is an important document that's considered legally binding, considering, of course, it. Set up the amortization table for starters, define the input cells where you will enter the known components of a loan: Commencing on the 1st day of april, 2024 and on the first of each month thereafter, principal and interest shall be payable in installments of $100,000 per month. It is a legal document for a loan and becomes legally binding when. Discover the answers you need here! A promissory note is a written promise made by a borrower to a lender to repay a specified sum of money. Web create a printable amortization schedule with dates and subtotals to see how much principal and interest you'll pay over time. Web make a secured promissory note (fully amortized) in minutes. Web the lender can use an amortization schedule to showcase the borrower's promise to pay back the loan either through regular payments or a lump sum. Web assignment of promissory note form with amortization schedule category: Web the free promissory note below is downloadable in microsoft word format it is designed for an unsecured loan, and it require that you calculate the amortization & repayment schedule (interest and payment schedule). Web payment schedule and amounts: Web this package contains everything you’ll need to customize and complete your secured promissory note. Web with an amortization schedule template for microsoft excel, you can enter the basic loan details and view the entire schedule in just minutes. An unsecured promissory note (fully amortized) is a promise to pay back a loan when there's no collateral, and it'll be repaid in equal installments that have different proportions of interest and principal. Accrued interest only on this note shall be paid monthly on or before the first day of each month starting november 1, 2023, through march 31, 2024. There’s no longer a need to waste money on attorneys to compose your legal paperwork.24 Free Loan Amortization Schedule Templates (MS Excel)

24 Free Loan Amortization Schedule Templates (MS Excel)

Amortization Schedule Template Free Word Templates

24 Free Loan Amortization Schedule Templates (MS Excel)

24 Free Loan Amortization Schedule Templates (MS Excel)

24 Free Loan Amortization Schedule Templates (MS Excel)

24 Free Loan Amortization Schedule Templates (MS Excel)

24 Free Loan Amortization Schedule Templates (MS Excel)

24 Free Loan Amortization Schedule Templates (MS Excel)

24 Free Loan Amortization Schedule Templates (MS Excel)

Related Post: